- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 395

Was an insane day.

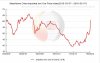

After a ripping week like last week you normally expect a bit of consolidation on the Friday afternoon and Monday morning at the very least. Especially if it is heading into resistance and a yearly high.

Any one short on the opening today should have sh@t their pants as it opened higher and simultaneously broke resistance at $2.65 and by the looks of they did it did!!

Remembering they are producing a lower grade product than RIO and BHP and have been changing mining techniques by reducing waist removal to Ore production which is not sustainable.

They will have to move more waist to Ore mined than they did at much higher cost levels to get rid of the surplus waist as well as moving normal amounts of waist for future Ore.

Not sure how long they can sustain that for before they have to raise costs and mine normally!

Further the market seems to be thinking that China is going back to it's old ways and heading into another real estate acceleration through easy money to everyone!

This is also an internal perception with the Chinese too, with those who have money and who also went sick on Shanghai real estate over the last month under the impression that finally the dictators have capitulated and resorted to going back to their old way of faking the economy.

They think the dictatorship has capitulated and is going to allow the mad building like before. This is a mistake and when the market realizes this isn't going to happen -

Be selling and back short.

After a ripping week like last week you normally expect a bit of consolidation on the Friday afternoon and Monday morning at the very least. Especially if it is heading into resistance and a yearly high.

Any one short on the opening today should have sh@t their pants as it opened higher and simultaneously broke resistance at $2.65 and by the looks of they did it did!!

Remembering they are producing a lower grade product than RIO and BHP and have been changing mining techniques by reducing waist removal to Ore production which is not sustainable.

They will have to move more waist to Ore mined than they did at much higher cost levels to get rid of the surplus waist as well as moving normal amounts of waist for future Ore.

Not sure how long they can sustain that for before they have to raise costs and mine normally!

Further the market seems to be thinking that China is going back to it's old ways and heading into another real estate acceleration through easy money to everyone!

This is also an internal perception with the Chinese too, with those who have money and who also went sick on Shanghai real estate over the last month under the impression that finally the dictators have capitulated and resorted to going back to their old way of faking the economy.

They think the dictatorship has capitulated and is going to allow the mad building like before. This is a mistake and when the market realizes this isn't going to happen -

Be selling and back short.

, very likely the move was influenced by expectations around this weekends China National Peoples Congress, but I doubt many heavy players would be foolish enough to be short into an event like the NPC. Much more likely that interested participants would use todays move to initiate such positions.

, very likely the move was influenced by expectations around this weekends China National Peoples Congress, but I doubt many heavy players would be foolish enough to be short into an event like the NPC. Much more likely that interested participants would use todays move to initiate such positions.