- Joined

- 25 August 2004

- Posts

- 390

- Reactions

- 0

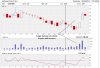

You have to be careful that the price movement before the big announcement is not just speculators moving in or out just before an announcement is due. More often than not the announcement is well and truely expected to occur around a certain date as companies keep everyone informed. eg quarterly and annual statements all include current work in progress and anticipated dates when results are expected.

totally agree with some high profile oil drills seems that people are waiting for something to leak right on pay dirt... the price moves a bit a certain way then speculators either bail or jump on causing it to run quickly. I remember one that did this only to release that thier results would be delayed a day or two more because of a well malfuntion - but judging form the movement you would have been certain that good news was getting out. With these expected price sensitive ann its virtually impossible to establish whether thier was any inside trading or not.

Unexpected ann out of the blue with big volume and price spikes are always suspect tho