- Joined

- 21 July 2007

- Posts

- 375

- Reactions

- 46

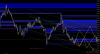

So it made 12.5 and IMO usually they set the price at some 'mid-point' prior to larger attempts at price movement, which is exactly what's taking place here, clearly visible on the USDCHF also.

If they can get this up to 13.3 before NFE release in over 24hrs we should see another top put in, highly unlikely IMO, so then I can put on another pair of shorts. It does look like they are attempting to cap this around mid to high 12's so they can push either way.

One option ruled out which means a 12.5 stretch or lookout 13.3ish here we come. if US data is a shocker its possible to 13.75 could be on the cards. I'm still not in. If I had a fat account I would have a short on already.

For those who give a toss about my views, I definitely don't follow the notion that bad news equal price drop, good news equal price jump, learnt a long time ago that's bollocks, and news is just a catalyst.

If they can get this up to 13.3 before NFE release in over 24hrs we should see another top put in, highly unlikely IMO, so then I can put on another pair of shorts. It does look like they are attempting to cap this around mid to high 12's so they can push either way.

One option ruled out which means a 12.5 stretch or lookout 13.3ish here we come. if US data is a shocker its possible to 13.75 could be on the cards. I'm still not in. If I had a fat account I would have a short on already.

For those who give a toss about my views, I definitely don't follow the notion that bad news equal price drop, good news equal price jump, learnt a long time ago that's bollocks, and news is just a catalyst.