- Joined

- 15 January 2006

- Posts

- 23

- Reactions

- 0

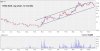

I suppose it depends on how long you want to keep that investment. Studying technical analysis at the moment, books are talking about following trends. So according to what I've read, that would not necessary be a good thing to buy while it is trending down unless your trading period is long enough to show an uptrend (ie: a year).

As you can see on the left, I'm a newbie. So don't flame me if I'm wrong

As you can see on the left, I'm a newbie. So don't flame me if I'm wrong