bluekelah

StockFan

- Joined

- 25 March 2013

- Posts

- 246

- Reactions

- 539

Despite years of touting full self driving capabilities and charging some customers for the "FSD" add on, Tesla is still stuck at Level 2 Automous which they will probably be stuck for a while with a history of so many crashes.What is Nokias market share now? What was it before? Why didn’t they make the jump and compete with Apple and Samsung?

Time will tell, but when it comes to Ev’s there is a lot of factors that give Tesla a major advantage eg their charging networks and self driving software just to name two.

I mean will BMW be considered a premium brand if their vehicles can’t drive them selves and it’s hard to find charging locations?

Tesla is well ahead of the other brands when it comes to full self driving, they are years ahead in development, will the others even be able to catch up?

Why Is Tesla’s Full Self-Driving Only Level 2 Autonomous?

The beta of Tesla’s Full Self Driving isn’t exactly the completely autonomous driving we were promised, and never will be according to recently revealed emails. Have early adopters been fooled?

www.forbes.com

www.forbes.com

Its always fun to watch the footage of the Tesla fireballs and accidents:

Watch: Tesla In Autopilot Crashes Into North Carolina Police Vehicle

Tesla Model S Plaid reportedly catches fire in Pennsylvania

More recently massive recall...

[The National Highway Traffic Safety Administration has issued a recall notice for 53,822 Tesla vehicles with the FSD Beta software as it may allow vehicles to roll through an all-way stop intersection.]

US authority issues recall for Tesla's rolling stop feature

Tesla has agreed to remove the controversial 'rolling stop' feature from its Full Self-Driving Beta after meeting with a US government agency.

Charging stations are not that big a differentiating factor as most EV adopters are using the EVs in mostly urban scenarios, not cross country runs. In time there will likely be more charging stations for other brands as we are seeing now in many urban centers that are seeing increased EV adoption.

Market share wise lets look at the biggest EV market China first, this is the 2021 sales record with BYD outselling Tesla by about 50%:

2021 EV deliveries in China by the numbers: How some of the market's major players grew

A breakdown of 2021 EV deliveries from some of the growing and best known automakers currently developing vehicles in China.

electrek.co

electrek.co

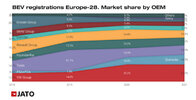

Second largest market Europe, VW Group getting 25% of market sales vs 13.9% of Tesla, which has seen their market leading percentage of 31.1%in 2019 shrink down, perhaps it can fight back with gigafactory Berlin. :

2021 (Full Year) Europe: Best-Selling Electric Car Models and Brands - Car Sales Statistics

In 2021, Tesla and Volkswagen were the best-selling electric car brands in Europe with the Model 3, Renault Zoe, and ID.3 the top-selling models.

www.best-selling-cars.com

www.best-selling-cars.com

And lets look at globally including north american sales, Tesla still has that 14%, which granted has changed much since 2019 where it had 16% of global market share:

Competition Heats Up For Tesla In EV Market

Tesla and Volkswagen are the leading EV producers. China has the largest EV market. What other companies are vying for market share? Read to learn more.

www.forbes.com

www.forbes.com

Tesla leads all others, selling slightly over 936,000 units in 2021. This gave the company a market share of nearly 14%. Close behind Tesla was the VW Group, with just over 11% of the market last year. Chinese-based BYD was third (9%); followed by GM (7.6%); Stellantis, an Amsterdam-based company (6%); Hyundai Motor (5%); and BMW Group (4.8%). Mercedes and Toyota were in the top 12. Ford was noticeably absent.]

Going forward the EV sector is likely to grow more globally. However I believe with FORD/RIVIAN with their EV trucks and every other major car maker jumping onto the EV bandwagon, I believe the EV space will get increasingly even more crowded with the bigger players. We can expect more competition and with that likely some level of margin compression at Tesla, or they may maintain margins but lose market share.

Valuation wise, without tech bubble and all the autonomous driving hype, I believe Tesla valuation should come back down to probably PE of 25-30.