- Joined

- 20 July 2021

- Posts

- 11,671

- Reactions

- 16,260

only triple ???

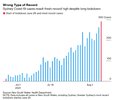

i think there was more cash splashed than that , look when the debt ceiling limit has been hit this year ( considering the limit was suspended last year )

ALSO the stimulus is unlikely to stop this year ( no matter what Congress and Senate vote )

but good on you for asking the question

cheers

another question MIGHT will non-government ( US ) entities continue buying Treasury Bonds ( if the Fed buys almost all of them directly ... that has got to effect the credit-ratings on the Bonds )

i think there was more cash splashed than that , look when the debt ceiling limit has been hit this year ( considering the limit was suspended last year )

ALSO the stimulus is unlikely to stop this year ( no matter what Congress and Senate vote )

but good on you for asking the question

cheers

another question MIGHT will non-government ( US ) entities continue buying Treasury Bonds ( if the Fed buys almost all of them directly ... that has got to effect the credit-ratings on the Bonds )