- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

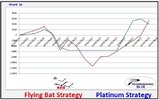

the bat is reaching for the sky, leaving that lead footed shiny Platinum showoff behind

Trading non-related strategies

At times trading non-related strategies smooth the equity curve. Combine that with two different trading styles one being more aggressive than the other & the nail-biting aspect of trading becomes less of an issue. The combined results are ultimately what we strive for. Rating a strategy by performance is highly overrated as the combination of the performance is more meaningful.

Combination of two non-related strategies

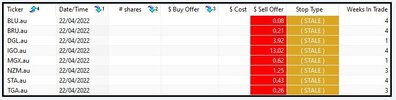

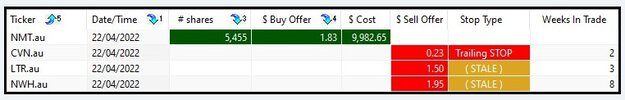

Instead of trading "one" 20 position portfolio, the "Shootout" trades "two" 10 position portfolios & after 16 weeks both strategies are now in profit. When you first start trading a new strategy it's really disappointing to experience immediate drawdowns when your portfolio goes underwater. Accepting early losses is easier to handle if you have confidence in your own work. Most traders lack patience & at times lack the knowledge of how "system trading" really works.

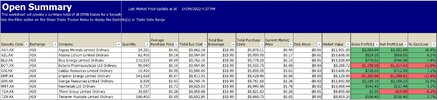

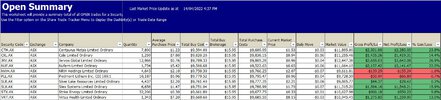

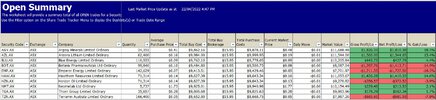

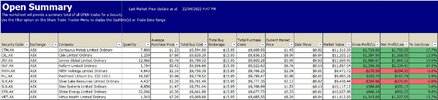

Combined Dashboard

The Individual Equity Curve

Skate.