- Joined

- 8 June 2008

- Posts

- 14,055

- Reactions

- 21,156

How is Mrs Skate handling the negative results so far?

Isn't it a play you can not win?

If a success..expected...

If a failure, blames ahead?

How is Mrs Skate handling the negative results so far?

How is Mrs Skate handling the negative results so far?

Isn't it a play you can not win?

If a success..expected...

If a failure, blames ahead?

How is $20 round trip 2% of $20000?@qldfrog, Mrs Skate fully realises negative returns early are to be expected as it takes time to fill a strategy & become profitable. Mrs Skate also realises the amount of work that goes into every one of my strategies. The success of the "Zebra Strategy" is expected by both of us.

Strategy failure

Failure of this strategy will be caused by "unexpected" trading conditions & hopefully not because of the "inadequacies" of the strategy.

It's tough

It's hard trading for most of us at the moment & its been a real slog these past few weeks.

Trading a low $20k portfolio with $10 commission is not helping

The round trip is 2%, ouch!! - early days yet. Short term results are not the measure of any strategy. Trading is a "marathon, not a sprint"

Women traders

I've found women to be better traders as they are able to handle the riggers of trading much better than us macho men, they can handle the emotional side of trading - much, much better. Also, women shine under pressure. Well, mine does.

Skate.

Couple of days late, but happy 2nd anniversary for your Dump it Here thread Skate.

I know my trading eyes are quite a bit wider from all the knowledge shared by all those that have contributed. Thanks for taking the time everyone to pay back what you've been taught, learned, or figured out never to do again!

Cheers!?

? ? ? ?

How is $20 round trip 2% of $20000?

Mr Skate, Is there a 'system' hiding in here?

@ducati916, this question is beyond my "pay grade".

As you have asked a question I feel that I should at least respond

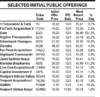

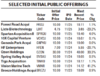

There is not a Technical analysis system that I know of that can take advantage of an IPO listing. In the secondary market, Technical analysis takes advantage of price movements looking for market inefficiency with no regards to the true value of the company but it’s perceived value. The perceived value is whatever a person is "willing to pay".

Fundamental analysis looks for an underpricing of the IPO

Fundamental analysis helps figure out if the companies IPO price is valued at a discount (lower than you believe it is worth). Fundamental analysis is the vehicle of choice as past earnings can be valued. The price movement in the first week (IMHO) can be explained by either (a) the IPO's inaccurate pricing methodology, (b) incomplete disclosure of the fundamentals of the company or (c) something other than public knowledge. The IPO "initial" price is a "guesstimate of value" but once it goes to the secondary market it's open slather a "free-for-all" with no buying or selling restrictions. The secondary market "price" (value) is always correct by consensus.

Technical Analysis

With more trading data the scrutiny of the technical analysis comes into its own. In my opinion, there is no "system" hiding in the "captures" you have uploaded.

Skate.

@stasisbr, the backtesting was conducted on the "All Ordinaries" XAO.

Your backtest is on XAO including past constituents?

@willy1111 thank you for doing this backtest for me. Looking at the comparison between the backtests with & without (Norgate's Index Constituent) the results are "chalk & cheese", being miles apart. The backtest results confirm it pays to have the Norgate's Platinum subscription when developing a new strategy.

@CNHTractor your follow up post confirms @willy1111 sentiment about the inaccuracies of backtesting results when you are not using Norgate's historical index constituents. Note to self, "refrain from posting backtests in the future"

F.Y.I

1. For strategy development using Amibroker you certainly need Norgate's Platinum Subscription package

2. When trading a strategy using Amibroker all you need is the Australian Stocks (Silver Package) - the package I have

How about

@julo, would you be kind enough to upload the WTT results without using "Current and Past watchlist" for a direct comparison to the results I posted previously? - I'll do the same when I get a break from trading today.

I actually don't think that is a direct comparison. You are using a different universe - low price shares. I know that price leverage can improve it a lot.

Hi skate. @Skate I’ve been testing out your WTT code and playing around with some figures etc. I’m not new to coding just new to Amibroker. Albeit my coding skills are very limited. So just fiddling.

I noticed something which i can’t explain so hoping you may be able to.

Using your Standard wtt code , I used the explore button to get me signals for a particular week. In this case let’s say 20th jan 19 to 25th jan 19. I get about 4 buy signals. When I click on the backtest with the exact period, I get about 8. 4 exactly the same as “explore” plus another 4. What’s the deal that?

I am going to assume that would not accurately resemble live trading which makes the backtest redundant..

thoughts?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.