- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

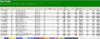

Hi Skate, how long do you usually paper trade before you decide to trade live or discard or change the system?View attachment 106533

For full disclosure

The records below brings the "HappyCat Strategy" in line with the "Action Strategy" listing all the relevant details for full disclosure. Percentage folio returns will be interesting to track. The "HappyCat Strategy" will be paper traded in the same way as I would trade any new strategy. Position sizing starts at $15k & will max out at $25k.

View attachment 106534

View attachment 106535

View attachment 106536

View attachment 106537

View attachment 106538

View attachment 106539

Skate.

Hi Skate, how long do you usually paper trade before you decide to trade live or discard or change the system?

A question that may have been answered in the 3,500 posts prior to this one, but I am curious how others feel on a number of factors in developing a system. I'll place this in 2 parts, 1 part the questions, and then 1 part my thoughts (as narrow minded as they may be)

Part 1 - Questions

1) position sizing - what impact does this have on your decision making process on how to employ a system within your portfolio of systems.

2) universe of assets being traded - what controls do you like to employ to ensure you are actually able to exit a trade, and that you maintain a 'comfort level' with the trade

Part 2 - Thoughts

1) Position Sizing - I believe that a good system has your Alpha/Edge/Absolute Awesomeness whether it is fixed, fractional or percentage based position sizing, it is broken it if only works with one.

But I also believe there is benefit in trading fixed amounts for certain strategies, and that there is benefit for increasing position sizing for others.

Fixed Positions can provide greater risk management as you can possibly increasing your number of positions and take more positions rather than increasing a position size. Downside is impact of commissions and more work inputting trades.

Fractional/Increasing Position sizes allow you to compound your return without increasing cost or workload. You do however decrease your 'comfort level' and take on significantly more risk.

2) Universe - I personally like to see liquidity in both volume and turnover in a stock over a look back period, so that I know that when I want to get out, I should have a good confidence level of doing so.

This has meant that when I apply these overlays I can trade quite a few stocks outside the ASX200 and even ASX300 that I may have otherwise missed if I restricted my self to those indexes.

Counterpoint I may have lost and may continue to lose some opportunity in less liquid but potentially better performing stocks.

TLDR - I Like to use both Fractional and Fixed Position Sizing as they provide diversification and return smoothing. Whilst I don't need to use Volume, Turnover or Price to enter a trade - they give me my 'comfort level' so I can feel confident that when the world goes upside down I can cash my chips in.

Attached is an example of the difference in position sizing for my BBO Strategy (Daily) from 01/07/2015 to 30/06/2020.

My understanding - position sizing has to take into account

@WilsonFisk is 100% correct in his statement.whether it is fixed, fractional or percentage based position sizing, it is broken it if only works with one.

Fixed Positions can provide greater risk management as you can possibly increasing your number of positions and take more positions rather than increasing a position size. Downside is impact of commissions and more work inputting trades.

Houston we have a problem - if you have a successful trading system the compounding effect of using a "fractional position sizing" as I said previously - it becomes very hard to move large amounts into the markets incurring a large amount of slippage.Fractional/Increasing Position sizes allow you to compound your return without increasing cost or workload. You do however decrease your 'comfort level' and take on significantly more risk.

Houston we have a problem - if you have a successful trading system the compounding effect of using a "fractional position sizing" as I said previously - it becomes very hard to move large amounts into the markets incurring a large amount of slippage.

When you say pyramiding , (a) do you mean increasing position size for next trade or (b) buying more of same trade at higher price?

Also - wanted to thank all contributors to this thread - it has made some good shifts in my thinking around developing future systems. I have found the index filter vs sentiment filter a really good read and my BBO Daily Strategy v4 will move from index to volatility filtering, with some pretty satisfying results (I hope). This mammoth bible of info, has inspired me to code more systems over the last 12 months, than I had done to date (out of many years investing and trading). Many of those systems suck, but it is a learning journey.

If you have 20 positions on and close one with profits and Capital greater than 5 % of capital isn't there an issue with one position being a lot greater than the others?What is the Re-Balancing Formula?

Trading Bank Balance/outstanding positions = new "PositionSize"

This will now be the new bet for each & every pending trade (the new PositionSize also calculates the number of shares to buy in the pre-auction)

it can also get the other way, you are fully invested then sell a loser: you lost 25% let's say from initial buy as initial amount per position...If you have 20 positions on and close one with profits and Capital greater than 5 % of capital isn't there an issue with one position being a lot greater than the others?

I was thinking of adding profits to Capital and dividing by 20, being total position size and would be the size of the bet for the remaining position?

Hi qldfrog, If you lose 25% on one trade and only have one position to fill why would you use all of the Capital on one trade. Especially as a trend trader when the next trade can just as likely be a loss than a win.it can also get the other way, you are fully invested then sell a loser: you lost 25% let's say from initial buy as initial amount per position...

your next buy has no other cash than that sale, which is under your expected amount per position, unless you top up with a cash buffer.

This is an issue which happens to me regularly and I sort it by just applying [inverse ]pyramiding;

position size =available cash/nb of available free slots.

Not backtested as optimum,just real world meeting theory

hope it helps

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?