- Joined

- 13 February 2006

- Posts

- 5,056

- Reactions

- 11,448

Tether: https://www.404media.co/tether-has-...g-tool-for-mexican-drug-traffickers-feds-say/

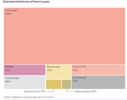

Private Equity: https://www.bloomberg.com/graphics/...9.DBu2iS9T2u70t25htHRjdn9iceSjPIKmbXkJV1Ww_I4

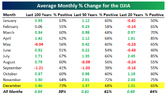

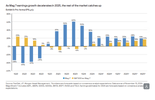

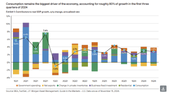

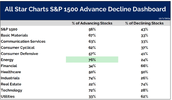

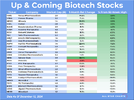

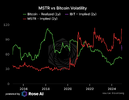

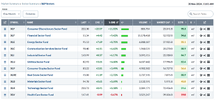

So as we enter the last month of the year, markets are having a good year.

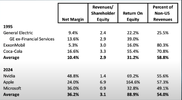

Financials leading the pack.

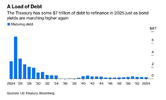

The Fed:

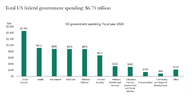

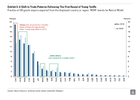

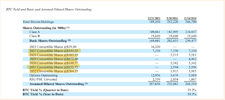

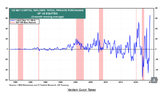

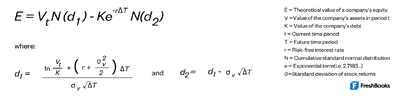

Massive unrealised losses

Not helping the Treasury.

And of course the banks were benefitted again via BTFP as of course the banks were regulated into holding huge amounts of UST, which have declined precipitously.

House of cards.

jog on

duc