You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DDTT

- Thread starter ducati916

- Start date

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 8 June 2008

- Posts

- 13,207

- Reactions

- 19,472

Now the BIG question: was it worth it?

$, thrill, knowledge gained?

$, thrill, knowledge gained?

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

Now the BIG question: was it worth it?

$, thrill, knowledge gained?

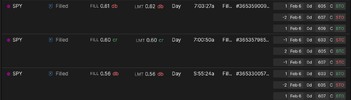

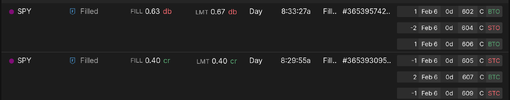

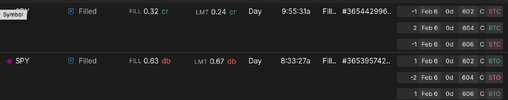

So as I drove into and then back home from work, I reflected on the trades:

So let's recap:

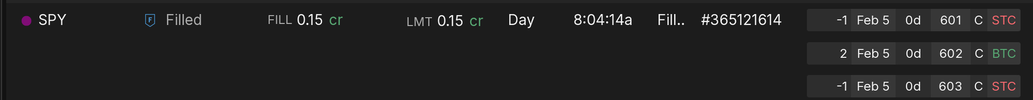

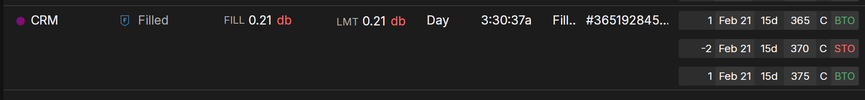

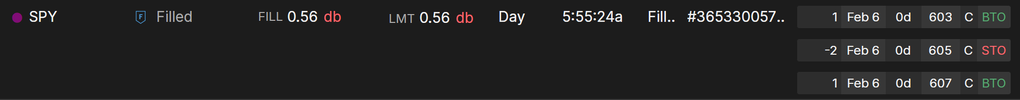

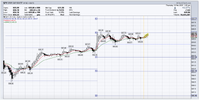

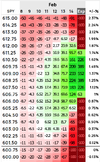

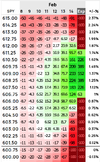

This was where I entered the first trade of the day.

>$603.53 and <$606.46

Yesterday had been a trend day, today looked at this point to be rangebound.

First lesson: there was no particular need to enter the trade this early. Easily can wait till 2pm

Looked pretty strong at this point.

My concern was (a) bull move yesterday and (b) strong open today. Where was the next PP level?

It was at $608.07

Hence I rolled higher

Now

>$605.60 and <$608.40

Then came the drop, pretty fast it has to be said

At the circled area, I was 99% confident it would trade back higher.

But how much higher was the issue.

I thought to the $605 area +/-.

Hence the last roll to:

>$602.67 and <$605.33

1. Could have chosen the 'P' level for the short strikes, call $604-$606-$608, which would have been fine.

2. Unconventionally I could have bought back 1 short strike in this trade:

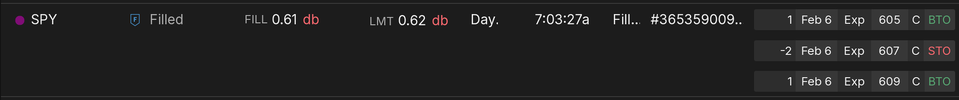

Unfortunately I didn't grab a screenshot of the actual prices at the yellow circle, but they were $0.00 at the bottom.

So allow a bit of thinking time, execution time, I could probably have closed it at $0.10 +/- or a $1.00+ profit.

Now you have an unbalanced butterfly +1 (-1) +1 and $100 profit.

Just assuming the best outcome for the moment:

The $605 Call would have been worth $121.00

The short $607 Call $0.00

The $609 Call $0.00

There are only 2 types of possible outcomes: (a) trend day (PP) target or (b) range day, identify the range

Today was a range day, just a volatile range LOL.

So same sort of plan for tomorrow, just enter a bit later in the day, unless I get a strong pullback earlier in the day.

Looking at the daily, it really wasn't that volatile, although it felt like it at the time.

If anyone has any bright suggestions, feel free to chime in.

jog on

duc

Attachments

- Joined

- 12 January 2008

- Posts

- 7,360

- Reactions

- 18,395

Love a good recap, puts me in a contemplative mood.

I seems that using options requires one to have a bias on where price will end the day. Get it right and there's a good payout when using the butterfly. So it all comes back to the W%. Long shots have low W%. It very similar to my $20 to $500 betting experiment. Currently I've succeeded only 2/37 times but it's a winner overall (so far).

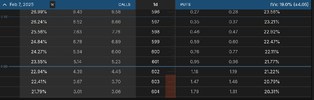

I'd would like to see the market stats to learn the probabilities of where the market tends to end the day. What are the odds of ending the day in each of the PP zones?

I seems that using options requires one to have a bias on where price will end the day. Get it right and there's a good payout when using the butterfly. So it all comes back to the W%. Long shots have low W%. It very similar to my $20 to $500 betting experiment. Currently I've succeeded only 2/37 times but it's a winner overall (so far).

I'd would like to see the market stats to learn the probabilities of where the market tends to end the day. What are the odds of ending the day in each of the PP zones?

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

Love a good recap, puts me in a contemplative mood.

I seems that using options requires one to have a bias on where price will end the day. Get it right and there's a good payout when using the butterfly. So it all comes back to the W%. Long shots have low W%. It very similar to my $20 to $500 betting experiment. Currently I've succeeded only 2/37 times but it's a winner overall (so far).

I'd would like to see the market stats to learn the probabilities of where the market tends to end the day. What are the odds of ending the day in each of the PP zones?

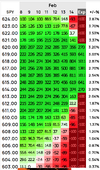

Peter,

Good question

So

R1 = $605.92

P = $602.28

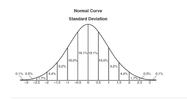

$612 = 1STD or 16%

$617 = 2STD or 9%

$601 = 1 STD or 16%

$596 = 2 STD or 9%

So the full range today, Low = $602.63 and High = $606.45 fall well inside a normal distribution.

A Black Swan event in part of the day is possible of course, flash crash type of event. But on known market move days, Fed., or earnings, simply don't trade.

With defined risk, you just take the max loss worst case.

Just been looking at Strangles. Good payer, undefined risk though. Absent a BS event, you'll get paid.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

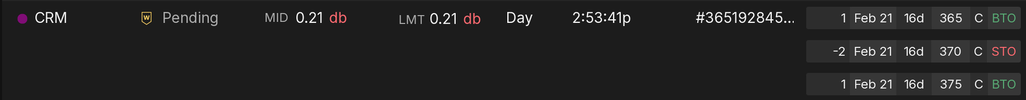

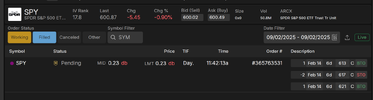

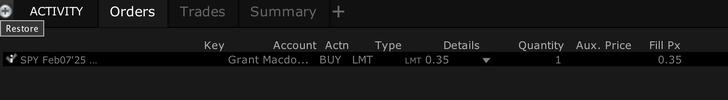

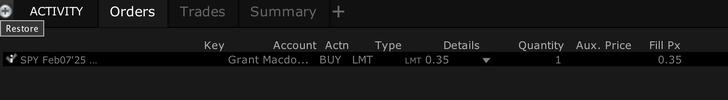

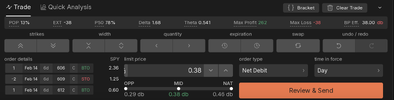

Ok bought

Which is a CALL @ $604

Max Loss $0.35

Max Gain ..........

****______________________

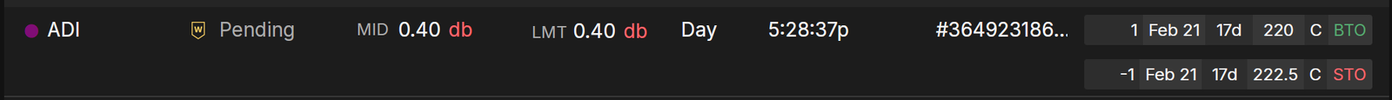

So the 'risk' seemed to be to the upside when I was trying to construct a butterfly.

So rather than fiddle about, when the market broke a few minutes ago, I bought a straight CALL at $604 which had in the last 2mins come back 50% from $0.73

Also this is the mid-day low volume period.

Volume should pick up into the close.

jog on

duc

Which is a CALL @ $604

Max Loss $0.35

Max Gain ..........

****______________________

So the 'risk' seemed to be to the upside when I was trying to construct a butterfly.

So rather than fiddle about, when the market broke a few minutes ago, I bought a straight CALL at $604 which had in the last 2mins come back 50% from $0.73

Also this is the mid-day low volume period.

Volume should pick up into the close.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

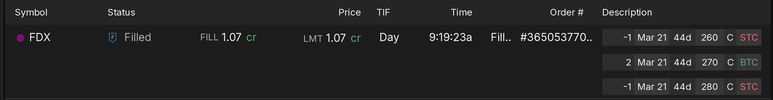

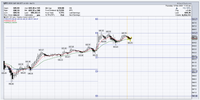

Ok lessons learned.

Trading the chop is hard. LOL.

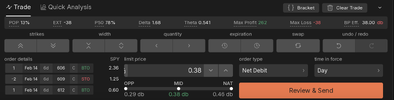

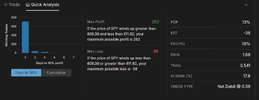

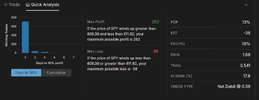

So while I was unsuccessful, there are the beginnings of a swing strategy:

1 month

10 days

5 days

So I'll trade the 10 day chart with reference to higher and lower timeframes.

Monday means that I get long, assuming no massive gap higher.

I'm actually looking for a gap lower to $594+/-.

With a return to $609 by the EOW.

So I'll place a butterfly at $609

So for some extra risk, I've spread the bands wider.

Distribution:

I've placed the trade to be executed on Monday with a limit for the $0.38 spread. If it does gap lower, I may (hopefully) get a price improvement.

Now I just leave it alone. LOL.

jog on

duc

Trading the chop is hard. LOL.

So while I was unsuccessful, there are the beginnings of a swing strategy:

1 month

10 days

5 days

So I'll trade the 10 day chart with reference to higher and lower timeframes.

Monday means that I get long, assuming no massive gap higher.

I'm actually looking for a gap lower to $594+/-.

With a return to $609 by the EOW.

So I'll place a butterfly at $609

So for some extra risk, I've spread the bands wider.

Distribution:

I've placed the trade to be executed on Monday with a limit for the $0.38 spread. If it does gap lower, I may (hopefully) get a price improvement.

Now I just leave it alone. LOL.

jog on

duc

Last edited:

- Joined

- 13 February 2006

- Posts

- 5,255

- Reactions

- 12,087

Similar threads

- Replies

- 6

- Views

- 3K