wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,743

- Reactions

- 12,920

Wayne, aside from Pivots, what other tools do you like to use in trading commodities?

Cheers,

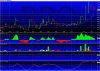

I use different tools for different contracts. As I only look at less than 30 charts, I can do that and some contacts behave completely differently to each other.

Also it depends whether I'm trading a swing, or trying to pick up a trend. But basically what you see on my intraday charts in this and the index thread is what I use in higher time frames as well. Just different parameters. I will throw a trendline on and maybe a fib retracement just for fun.

But thats it.

Oh and the ubiquitous oscillator on the bottom as discussed.