wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,747

- Reactions

- 12,930

Re: Daytrading- How to make a profit

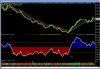

Hmmm I typed out a long reply and somehow deleted it I'll have to come back to this, but here is the code

I'll have to come back to this, but here is the code

/* wayneL's Daytrading Template - To be plotted on intraday charts */

GraphXSpace = 1;

/* This plots the price bars. Select whether you want candlesticks or ordinary bars via th "view" menu */

_SECTION_BEGIN("Price");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

_SECTION_END();

/* The following three codes are the exponential moving average flippers. These can be deleted or modified to suit */

_SECTION_BEGIN("10EMA Flipper");

mov = 10;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorYellow,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

_SECTION_BEGIN("20EMA Flipper");

mov = 20;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorWhite,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

_SECTION_BEGIN("34EMA Flipper");

mov = 34;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorRed,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

/* The next section calculates and plots the dynamic 3 day pivots */

_SECTION_BEGIN("3 Day Pivots");

Hi1 = IIf(Day()!=Ref(Day(),-1),Ref(HighestSince(Day()!=Ref(Day(),-1),H,3),-1),0);

Hi = ValueWhen(Day()!=Ref(Day(),-1),Hi1,1);

Lo1 = IIf(Day()!=Ref(Day(),-1),Ref(LowestSince(Day()!=Ref(Day(),-1),L,3),-1),0);

Lo = ValueWhen(Day()!=Ref(Day(),-1),Lo1,1);

Cl1 = IIf(Day()!=Ref(Day(),-1),Ref(C,-1),0);

Cl = ValueWhen(Day()!=Ref(Day(),-1),Cl1,1);

rg = (Hi - Lo);

bp = (Hi + Lo + Cl)/3;

r1 = (bp*2)-Lo;

s1 = (bp*2)-Hi;

r2 = bp + r1 - s1;

s2 = bp - r1 + s1;

Plot(s2,"",colorRed,styleBar|styleNoRescale|styleNoLabel);

Plot(r2,"",colorRed,styleBar|styleNoRescale|styleNoLabel);

Plot(s1,"",colorBlue,styleBar|styleNoRescale|styleNoLabel);

Plot(r1,"",colorBlue,styleBar|styleNoRescale|styleNoLabel);

_SECTION_END();

/* This next section calculates and plots the daily pivots using fibonacci ranges */

_SECTION_BEGIN("Daily Fib Pivots");

Hi1 = IIf(Day()!=Ref(Day(),-1),Ref(HighestSince(Day()!=Ref(Day(),-1),H,1),-1),0);

Hi = ValueWhen(Day()!=Ref(Day(),-1),Hi1,1);

Lo1 = IIf(Day()!=Ref(Day(),-1),Ref(LowestSince(Day()!=Ref(Day(),-1),L,1),-1),0);

Lo = ValueWhen(Day()!=Ref(Day(),-1),Lo1,1);

Cl1 = IIf(Day()!=Ref(Day(),-1),Ref(C,-1),0);

Cl = ValueWhen(Day()!=Ref(Day(),-1),Cl1,1);

rg = (Hi - Lo);

bp = (Hi + Lo + Cl)/3;

r1 = (bp*2)-Lo;

s1 = (bp*2)-Hi;

r2 = bp + rg;

s2 = bp - rg;

r2o = bp + (1.272*rg);

s2o = bp - (1.272*rg);

rh = bp + (0.5*rg);

rl = bp - (0.5*rg);

rh6 = bp + (0.618*rg);

rl6 = bp - (0.618*rg);

Plot(s2,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(r2,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(rh,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(rl,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(bp,"",colorYellow,styleThick|styleNoRescale|styleNoLabel);

Plot(rh6,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(rl6,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(r2o,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(s2o,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(s2o,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(s2,"",colorPlum,styleArea|styleNoRescale|styleNoLabel);

Plot(rl6,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(rl,"",colorDarkOliveGreen,styleArea|styleNoRescale|styleNoLabel);

Plot(rh,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(rh6,"",colorDarkOliveGreen,styleArea|styleNoRescale|styleNoLabel);

Plot(r2,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(r2o,"",colorPlum,styleArea|styleNoRescale|styleNoLabel);

_SECTION_END();

//--end----------------------------------------------------------------------------

pski said:Hi Wayne,

I have read some of Frank's posts on Reef and have just started AFL with Amibroker.

If the offer to provide the code still stands, I would be grateful so I may 1/ understand how you are working with Frank's theories and 2/ see how you have put it together to plot the chart in AFL.

Many thanks,

Peter

Hmmm I typed out a long reply and somehow deleted it

/* wayneL's Daytrading Template - To be plotted on intraday charts */

GraphXSpace = 1;

/* This plots the price bars. Select whether you want candlesticks or ordinary bars via th "view" menu */

_SECTION_BEGIN("Price");

SetChartOptions(0,chartShowArrows|chartShowDates);

_N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) ));

Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() );

_SECTION_END();

/* The following three codes are the exponential moving average flippers. These can be deleted or modified to suit */

_SECTION_BEGIN("10EMA Flipper");

mov = 10;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorYellow,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

_SECTION_BEGIN("20EMA Flipper");

mov = 20;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorWhite,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

_SECTION_BEGIN("34EMA Flipper");

mov = 34;

hi = EMA(H,mov);

lo = EMA(L,mov) ;

x1 = IIf(C>Ref(hi,-1),1,IIf(C<Ref(lo,-1),-1,0));

x2 = ValueWhen(x1!=0,x1,1);

st = IIf(x2==-1,Hi,Lo);

Plot(Ref(st,-1),"",colorRed,styleNoLine|styleBar|styleNoLabel);

_SECTION_END();

/* The next section calculates and plots the dynamic 3 day pivots */

_SECTION_BEGIN("3 Day Pivots");

Hi1 = IIf(Day()!=Ref(Day(),-1),Ref(HighestSince(Day()!=Ref(Day(),-1),H,3),-1),0);

Hi = ValueWhen(Day()!=Ref(Day(),-1),Hi1,1);

Lo1 = IIf(Day()!=Ref(Day(),-1),Ref(LowestSince(Day()!=Ref(Day(),-1),L,3),-1),0);

Lo = ValueWhen(Day()!=Ref(Day(),-1),Lo1,1);

Cl1 = IIf(Day()!=Ref(Day(),-1),Ref(C,-1),0);

Cl = ValueWhen(Day()!=Ref(Day(),-1),Cl1,1);

rg = (Hi - Lo);

bp = (Hi + Lo + Cl)/3;

r1 = (bp*2)-Lo;

s1 = (bp*2)-Hi;

r2 = bp + r1 - s1;

s2 = bp - r1 + s1;

Plot(s2,"",colorRed,styleBar|styleNoRescale|styleNoLabel);

Plot(r2,"",colorRed,styleBar|styleNoRescale|styleNoLabel);

Plot(s1,"",colorBlue,styleBar|styleNoRescale|styleNoLabel);

Plot(r1,"",colorBlue,styleBar|styleNoRescale|styleNoLabel);

_SECTION_END();

/* This next section calculates and plots the daily pivots using fibonacci ranges */

_SECTION_BEGIN("Daily Fib Pivots");

Hi1 = IIf(Day()!=Ref(Day(),-1),Ref(HighestSince(Day()!=Ref(Day(),-1),H,1),-1),0);

Hi = ValueWhen(Day()!=Ref(Day(),-1),Hi1,1);

Lo1 = IIf(Day()!=Ref(Day(),-1),Ref(LowestSince(Day()!=Ref(Day(),-1),L,1),-1),0);

Lo = ValueWhen(Day()!=Ref(Day(),-1),Lo1,1);

Cl1 = IIf(Day()!=Ref(Day(),-1),Ref(C,-1),0);

Cl = ValueWhen(Day()!=Ref(Day(),-1),Cl1,1);

rg = (Hi - Lo);

bp = (Hi + Lo + Cl)/3;

r1 = (bp*2)-Lo;

s1 = (bp*2)-Hi;

r2 = bp + rg;

s2 = bp - rg;

r2o = bp + (1.272*rg);

s2o = bp - (1.272*rg);

rh = bp + (0.5*rg);

rl = bp - (0.5*rg);

rh6 = bp + (0.618*rg);

rl6 = bp - (0.618*rg);

Plot(s2,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(r2,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(rh,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(rl,"",colorCustom12,styleBar|styleNoRescale|styleNoLabel);

Plot(bp,"",colorYellow,styleThick|styleNoRescale|styleNoLabel);

Plot(rh6,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(rl6,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(r2o,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(s2o,"",colorWhite,styleBar|styleNoRescale|styleNoLabel);

Plot(s2o,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(s2,"",colorPlum,styleArea|styleNoRescale|styleNoLabel);

Plot(rl6,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(rl,"",colorDarkOliveGreen,styleArea|styleNoRescale|styleNoLabel);

Plot(rh,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(rh6,"",colorDarkOliveGreen,styleArea|styleNoRescale|styleNoLabel);

Plot(r2,"",colorBlack,styleArea|styleNoRescale|styleNoLabel);

Plot(r2o,"",colorPlum,styleArea|styleNoRescale|styleNoLabel);

_SECTION_END();

//--end----------------------------------------------------------------------------