- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

All an inevitable occurance. They learnt nothing from GFC and as I and others said at the time, they simply delayed the inevitable and a bigger problem.

Buckle up, boyos.

I will take the under.

Banking and investment banking is very different now from the GFC, many lessons in fact have been learned.

I think forward returns on ex-AU investment banks (where valuations are already rich) will be above benchmark and they have strong tailwinds with both rising rates and volatile rates.

I think investment banks are oversold on GFC fears from people who don't understand anything and could offer strong upside surprise.

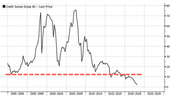

I do not believe either CS or DB will fail.

Not bad...