chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

I posted about this somewhere else:nioka said:Aluminium would not be a suitable substitute for nickel in coins. Copper has been used before and will be used again. Most 'silver' coins are only worth as much as the last of the copper ones anyway. Don't know how much influence it would have on either the copper or nickel price but it would have some. I'm sure the mint is looking at it by now.

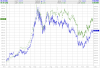

Nickel coins will soon be worth more as scrap metal.

https://www.aussiestockforums.com/forums/showpost.php?p=133822&postcount=248

When I last checked, our 20c coins are worth just over 19c. When you take into account other costs, there is very little difference between the face value, and metal value. Time to stock up on this years coins. Lol!

There are big problems right now with the US nickles. This is a little out of date:

http://en.wikipedia.org/wiki/Nickel_(United_States_coin)#Metal_value

They are now worth 10US cents in metal.