McCoy Pauley

Get out of here Budweiser!

- Joined

- 12 November 2009

- Posts

- 616

- Reactions

- 0

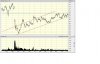

Looks like COH has the potential to fall through the bottom of the rising channel (see chart attached).

As a holder, would like to see the chart reverse course next week, but IMO, the sellers are in charge at the moment.

First half results should be emerging in about six weeks. This will give everyone an indication of the bottom line damage done by the recall.

As a holder, would like to see the chart reverse course next week, but IMO, the sellers are in charge at the moment.

First half results should be emerging in about six weeks. This will give everyone an indication of the bottom line damage done by the recall.