Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,252

- Reactions

- 22,185

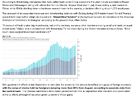

Has demographic decline led the world to wonder if it has reached peak China?

According to Paul Keating , who met with Chinese Foreign Minister Wang Yi in Sydney this week, Yang put on a brave face, emphasising that China was still only 55 per cent urbanised and had another 20 per cent to go.

According to Paul Keating , who met with Chinese Foreign Minister Wang Yi in Sydney this week, Yang put on a brave face, emphasising that China was still only 55 per cent urbanised and had another 20 per cent to go.