pixel

DIY Trader

- Joined

- 3 February 2010

- Posts

- 5,359

- Reactions

- 345

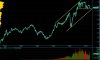

Hope you chartists have fun with your squiggly line voodoo. I just laugh when I see people use charts. Might as well be reading tea leaves.

I'll just stick to the fundamentals thanks

If you only know how to use a hammer, everything will look to you like a nail.

If you know the difference between a hammer, a soldering iron, and a saw, and if you can use all three with equal expertise, you will find it a lot easier to build something useful.