I haven't been to a stadium concert in a while. It's all a bit sterile.That’s how pretty much most events are, they collect the money on the way in, the last thing they want is slowing people down collecting payments when the stadium is emptying out at the end of the night, the traffic jams are bad enough as it is.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cashless society

- Thread starter sptrawler

- Start date

-

- Tags

- cash cashless society

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

the big one for me was at Chandler VelodromeI haven't been to a stadium concert in a while. It's all a bit sterile.

riot police , special police and that was BEFORE the event even started sadly someone miscalculated and there were more than 50 metal-heads for every police officer ( plenty of rapper fans as well )

all woke and safety conscious now ,

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,336

- Reactions

- 6,399

I’m at a cafe, asked for a Fredo Nero (long black on ice), and I’m told “sorry, eftpos is down”. Lucky I have cash, walking out now with my coffee.

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,237

- Reactions

- 8,483

it was pretty fast entry, you just tapped your card as you drove in on the parking attendants mobile eftpos machine, much quicker that counting cash and issuing change.Possibly, but wouldn't you risk missing the event if everyone is queued to pay to get in?

Unless it's all online?

Also everyone rushing the exits sounds about the same. I suppose the question to pay tickets at the end would be the same.

- Joined

- 14 February 2005

- Posts

- 15,307

- Reactions

- 17,550

As someone who's been to plenty of major events over the years, as a practical observation the whole idea of putting event tickets on a phone has definite problems.Possibly, but wouldn't you risk missing the event if everyone is queued to pay to get in?

Unless it's all online?

Always seems to end up with more than a few for whom, for whatever reason, it didn't work and they're queuing at the box office trying to sort it out and get in before the start of the show.

Same goes for printed tickets when they're withheld until the day before the event. That works really well when someone's travelled interstate etc and doesn't even have the email. Even better when Ticketek doesn't tell anyone the tickets are withheld at the time of purchase, and their own staff aren't even aware that's the case.

- Joined

- 14 February 2005

- Posts

- 15,307

- Reactions

- 17,550

The bigger the concert, the more sterile the crowd tends to be. Doubly so if you're so far away from the stage as to be in a seat.I haven't been to a stadium concert in a while. It's all a bit sterile.

Also depends a lot on the band and what sort of crowd they attract.

- Joined

- 28 August 2022

- Posts

- 7,061

- Reactions

- 11,448

Ah Cash was king there John DeI’m at a cafe, asked for a Fredo Nero (long black on ice), and I’m told “sorry, eftpos is down”. Lucky I have cash, walking out now with my coffee.

- Joined

- 28 August 2022

- Posts

- 7,061

- Reactions

- 11,448

Well if you are seated with the God's then there isn't much hope of seeing much, Probably sound wise might be OK. My experience not so flash. Haven't been to one in a long time.I haven't been to a stadium concert in a while. It's all a bit sterile.

Have become a very grumpy old man in the later years.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,336

- Reactions

- 6,399

Just read an interesting article, though 12 months old.

Why are 'emerging' countries so keen?

At the retail level, much of the world is moving slowly. Australia’s Reserve Bank says apart from the developed economies of Sweden and Canada, most of the economies advancing the idea are emerging, including the Bahamas, Cambodia, Eastern Caribbean, Ecuador, Nigeria and Ukraine.

Why are 'emerging' countries so keen?

Australia is investigating a digital currency, or e-dollar, but its benefits seem slight

We’re used to thinking of money as notes and coins, the kind most of us hold in our wallets. But most money – in Australia it’s 96.3% – is digital, held by financial institutions and moved around via bank transfers, debit cards and credit cards.

Late last year, Treasurer Josh Frydenberg promised to consult about introducing a third type of currency, a central bank digital currency, and asked the treasury to come up with a position by the end of 2022.

A central bank digital currency (CBDC) would be an “e-dollar”, each one worth $1 dollar, but able to be held digitally without being put into a bank – such as on computers or in digital wallets on phones.

It could allow direct consumer-to-consumer and consumer-to-business payments without the intervention of financial institutions, and allow people who don’t want to use banks to hold funds in a form that’s safer than cash.

It could also head off attempts by private firms – such as Facebook, which proposed something called Libra – to do the same sort of thing.

For transactions, it would have a clear advantage over so-called cryptocurrencies such as Bitcoin, whose values fluctuate because they’re not tied to a currency.

Many central banks are investigating the idea, but most say they’re unlikely to issue a retail CBDC in the foreseeable future.

Australia’s Reserve Bank is particularly unenthusiastic, declaring there is “currently no strong public policy case to introduce a CBDC for retail use”.

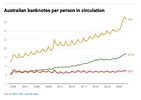

Whereas in much of the rest of the world the use of cash is shrinking, in Australia there are more banknotes in circulation as a proportion of the economy than at any time since the introduction of decimal currency in 1966.

Most of the cash appears to be used to store money rather than execute transactions. But if ever Australians could be weaned off cash, there would be savings for the Reserve Bank in the cost of printing and distributing cash, and also, most likely, fewer robberies.

But how the idea would work isn’t clear.

Like bus and train cards

One model would be to produce a digital token almost exactly the same as cash. Like a banknote, it could be passed from one person to another in anonymity, with no central authority involved.

The bus and train cards used in some parts of Australia are like this – unless an owner chooses to register ownership, there’s no record of who used the card.

One downside is that, unlike cash, very large sums could be held on very small devices, which could be stolen or lost. A New Zealand study notes that cash is relatively bulky, “making it unlikely that consumers would carry large amounts on their person or store large amounts in their homes”.

And it could facilitate illegal transactions. The current Coalition government is so concerned about the use of cash for illegal transactions that it introduced legislation – never enacted – that would have banned the use of cash for payments over A$10,000.

Banks and other organisations are already required to report transactions of $10,000 or more to the Australian Transaction Reports and Analysis Centre.

Or more like Bitcoin

An alternative, the one most often talked about as a consumer digital currency, would use blockchain technologies of the kind used in Bitcoin and other cryptocurrencies to register and track ownership, and verify transactions.

With blockchain, every transfer is recordable and hard to delete. The central bank (in Australia’s case, the Reserve Bank) would be able to track transactions.

Read more: Demystifying the blockchain – a basic user guide

It can be thought of as an account at a central bank, which could be used to transfer money to other accounts. In most models, the account would pay no interest.

And the central bank could limit transactions. Some, such as Bank of England Deputy Governor Jon Cunliffe, see this as an advantage.

He says it could be like:

“... giving your children pocket money but programming the money so that it couldn’t be used for sweets.”

In his book The Future of Money, Cornell University economist Eswar Prasad warns about societies in which central bank digital money becomes “an additional instrument of government control over citizens”.

China’s ‘programmable’ e-currency

In 2020, China became the first major economy to pilot a digital currency.

The consulting firm Oliver Wyman says the digital yuan will be “programmable”, and could be set to only be used for payments after “activation” when certain predefined conditions are met.

China’s government, but not other users, would have the ability to monitor transactions in real time, in what China calls “controlled anonymity”.

This isn’t what much of the rest of the world seems to want. A survey of European consumers finds the thing they most want from an e-currency is privacy (43%) ahead of security (18%) and offline usability (8%).

The United States is continuing to investigate the idea, pointing to benefits including getting payments quickly to people in times of crisis (assuming there are working electricity and internet connections) and providing services to the unbanked.

Privacy is the roadblock

Privacy isn’t of concern in the other arena central banks are moving ahead with plans for a digital currency – wholesale money. Australia’s Reserve Bank is well-advanced on Project Atom, which would allow financial institutions to transfer money between each other more quickly.

At the retail level, much of the world is moving slowly. Australia’s Reserve Bank says apart from the developed economies of Sweden and Canada, most of the economies advancing the idea are emerging, including the Bahamas, Cambodia, Eastern Caribbean, Ecuador, Nigeria and Ukraine.

They have weaker electronic banking infrastructure than Australia, and populations that can’t easily access physical banks.

This article originally appeared on The Conversation.

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

maybe they think it will reduce crime ( it won't )Why are 'emerging' countries so keen?

or maybe those leaders are all puppets of various factions

remember more than 80 million people ( allegedly ) voted for Joe Biden

They are keen because many emerging nations regularly suffer from rampant inflation and one needs a wheelbarrow full of money to buy a few things.Just read an interesting article, though 12 months old.

At the retail level, much of the world is moving slowly. Australia’s Reserve Bank says apart from the developed economies of Sweden and Canada, most of the economies advancing the idea are emerging, including the Bahamas, Cambodia, Eastern Caribbean, Ecuador, Nigeria and Ukraine.

Why are 'emerging' countries so keen?

If all money is controlled by the nation they can simply snip a few zeros off everyone's bank balance and all is well

Another option is to trim accounts if the Pres needs a new palace, was it Cyprus that deducted money from all bank accounts to repay some Euro loans?

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

it happened in Cyprus , but as far as i understood it the ( Cyprus ) government wasn't a willing participant in that saga ( i bet Cyprus won't rush to help out Greece next time either , but then Greece won't be rushing to help out Germany this time around )Another option is to trim accounts if the Pres needs a new palace, was it Cyprus that deducted money from all bank accounts to repay some Euro loans?

- Joined

- 28 May 2020

- Posts

- 6,634

- Reactions

- 12,727

problem is, the guvmint can pass a law saying cash is no longer legal tender, just like that.I'm worried that anything digital will get cracked with the upcoming AI boom. If anything, cash will be the safe bet.

Better off to have something you can barter with - maybe some veges, some timber, even a lump of coal!.

Mick

Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,237

- Reactions

- 8,483

Cash has always been susceptible to counterfeiting, I remember a conversation that was on you tube where an ex federal reserve employee said he believed up to 1% or 2% of USDollars on issue globally could be high quality counterfeits.I'm worried that anything digital will get cracked with the upcoming AI boom. If anything, cash will be the safe bet.

I assume there will be some digital scams possible, how large they are in relation to cash scams remains to be seen, but the economy operates just fine with scams and counterfeits, we just need to minimise them, but they don’t need to be zero, there will always be some base level of pirates out there.

- Joined

- 20 July 2021

- Posts

- 11,725

- Reactions

- 16,351

problem is, the guvmint can pass a law saying cash is no longer legal tender, just like that.

Better off to have something you can barter with - maybe some veges, some timber, even a lump of coal!.

Mick

well i am buying stuff with a long self life ( up to 3 years worth of tea bags for an example ) and not need to barter for everything

maybe stuff you can trade in the future quality knives , or basic tools ( in case they cut your power and internet as well )

try a couple of camping trips ( without the gas stove and plug in fridge ) and see want you need for survival in the wilderness ( or some abandoned building in the city )

and for the younger folk learn some skills where you can 'work for food ' when you need to

physical gold and silver will probably still have a place , but a dozen fresh eggs or a dozen apples will be swapped a lot quicker

- Joined

- 28 August 2022

- Posts

- 7,061

- Reactions

- 11,448

Good evening Mr Divs. The barter system though minor is in play in my household. has been for some time. I get a plentiful supply of fruit from my orcharist mate, which is then divied up around for eggs, lamb cuts and a host of other things. We have beef which also goes into the mix.well i am buying stuff with a long self life ( up to 3 years worth of tea bags for an example ) and not need to barter for everything

maybe stuff you can trade in the future quality knives , or basic tools ( in case they cut your power and internet as well )

try a couple of camping trips ( without the gas stove and plug in fridge ) and see want you need for survival in the wilderness ( or some abandoned building in the city )

and for the younger folk learn some skills where you can 'work for food ' when you need to

physical gold and silver will probably still have a place , but a dozen fresh eggs or a dozen apples will be swapped a lot quicker

Shows how weird some people are, I offered a person a few kilos of beef and fruit for diesel. Not interested because it didn't come from a supermarket. Apparently that is where all produce is grown!!!!!!!!

- Joined

- 28 May 2020

- Posts

- 6,634

- Reactions

- 12,727

FromThe Australian

Its the standard banking response, "take it or leave it.

“The majority prefer online and mobile banking methods.” says the bank.

Did the bank canvas its customers, or just let the paucity of cash services force then that way.

mick

As is so often the case, the decision as to whether we use cash or digital will be taken out o the hands of the customers.A major bank will end the handling of cash by branch employees and instead turn customers to ATMs and deposit machines in a controversial move critics say will further marginalise vulnerable people.

ANZ has revealed customers at some branches are no longer able to deposit and withdraw cash over the counter, with staff instead assisting people using onsite ATMs and coin deposit machines.

However, an ANZ spokesman declined to reveal what branches no longer offered the service and whether a ban on in-branch cash transactions would extend around the nation.

“There are a small number of branches where we no longer handle cash at a counter,” he said.

“At these branches, cash and cheque deposits and cash withdrawals can continue to be made by using our Smart ATM and coin deposit machines and we have staff on hand to help customers that might be using them for the first time.”

it comes amid a 30 per cent decline in the number of bank branches over the past five years with more than 1600 closed – many in remote areas.

The number of ATMs across the country has also plunged, with Australian Prudential Regulation Authority figures revealing the number of machines has more than halved from 13,814 in 2017 to 6412 in June last year.

ANZ said only about 8 per cent of its customers “solely rely” on branches for everyday banking, however critics warn the latest move could disproportionately affect older people and those with a disability.

“Our customers are changing how they bank, with more than a 50 per cent decline in in-branch transactions across ANZ over the past four years,” the bank spokesman said.

Its the standard banking response, "take it or leave it.

“The majority prefer online and mobile banking methods.” says the bank.

Did the bank canvas its customers, or just let the paucity of cash services force then that way.

mick

- Joined

- 8 June 2008

- Posts

- 13,133

- Reactions

- 19,328

I deal with cba and needed to transfer today huge amount..proceed from unit sale to other Australian banks accounts.FromThe Australian

As is so often the case, the decision as to whether we use cash or digital will be taken out o the hands of the customers.

Its the standard banking response, "take it or leave it.

“The majority prefer online and mobile banking methods.” says the bank.

Did the bank canvas its customers, or just let the paucity of cash services force then that way.

mick

I so wanted to raise the online transfer limit to $200 or 400k.

Had to call ,30min on the music waiting line..and can only do $100k at a time.

The operator suggested.. you can do it at a branch....

Thanks but 2 nearest branches have been closed in the less than 3y lived here....so now it is a 40 min one way drive

So yes all good as long as you fit in tge 80% of consumers. Anything else and the processes collapse...

Similar threads

- Replies

- 38

- Views

- 5K