- Joined

- 12 January 2008

- Posts

- 7,283

- Reactions

- 18,116

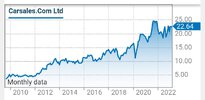

At (1) price didn't go higher but fell with the market.

At (2) price didn't go higher but fell with the market.

Now (3) the market is drifting down, but CAR is going sideways. A bit of bullish relative strength hey?

At (2) price didn't go higher but fell with the market.

Now (3) the market is drifting down, but CAR is going sideways. A bit of bullish relative strength hey?