Re: Scalping the DAX (SIM)

Out of curiosity, how many S/R setups you get in a avg day? 2? 4?

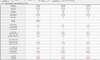

Why aren't you looking for set ups at Support and or Resistance?

Look for Volume coming into them. Fade it---unless it gaps through or convincingly breaks it.

Out of curiosity, how many S/R setups you get in a avg day? 2? 4?