Glen48

Money can't buy Poverty

- Joined

- 4 September 2008

- Posts

- 2,444

- Reactions

- 3

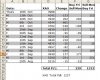

I notice prices start to go up about 11 am to 12- 12.30 pm and down from there how ever to get in on time is the problem one chart lasted 3 seconds before going down again.