Yer. The PPL levy paid by the top 3,000 companies will also not have franking credits attached because it's a "levy".

Largely under the radar but the devil is always in the detail.

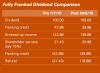

A retiree living on 100K of grossed up dividends would currently have a net income of $73,553 that will reduce by $1,290 directly as a result of the PPL being funded by a ‘levy’ and the implication on franking credits.

edit:

The above is for outside the super system

For inside super (over 60 and receiving tax free status) the current net figure is 100K reducing by $2,097.