You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bottom picking the All Ordinaries

- Thread starter Snakey

- Start date

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,006

3500Well by charting the all ords over the past 10 years I would say the bottom should be around 4800 but could be as low as 4200. Any one else like to give there newly updated figures?

3500

3500

lol, been hanging around the bears too long Kennas?

My best guess down for this leg is 4900-4950, after that not too sure at this stage, depends a bit on the next rally imo.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 204

Some time this morning we will get a low for this leg down.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,006

Snakey, need to do that on a semi log scale for reference.The red line top

The dark blue line bottom

The green line 50%(should settle back to here at least)

The yellow line worst case bottom( panic over shoot of half way point)

Snakey, need to do that on a semi log scale for reference.

As being a Jack of all trades and a master of one (not charting). I have no idea what your talking about

Care to give yours on a "semi log scale" for future reference? Or post reference link?

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,006

Scale that takes into consideration inflation.As being a Jack of all trades and a master of one (not charting). I have no idea what your talking aboutbut I think I know what you mean

Care to give yours on a "semi log scale" for future reference? Or post reference link?

For eg,

It's like comparing the price of an apple in the year 1900 to 2000.

And, I do not have one.....

doctorj

Hatchet Moderator

- Joined

- 3 January 2005

- Posts

- 3,271

- Reactions

- 8

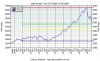

Personally, I reckon we're a fair way off the bottom in equity markets - the chart below represents the Dow Jones Index and the Volatility Index (VIX)... excuse the bad scaling, I had to use Yahoo Charts to get it.

What it does show is that significant bottoms tend to be put in place when the VIX is pushing 30. Right now it's just shy of 25, so I think there's a way to go yet.

Why is the VIX relevent for picking bottoms? The VIX represents movements in the premium paid by purchasing puts for protection in a downward market - bottoms tend to be put in when there is irrational fear and people/institutions want out at any price. Until we get that spike of fear, I don't think we've got a bottom.

What it does show is that significant bottoms tend to be put in place when the VIX is pushing 30. Right now it's just shy of 25, so I think there's a way to go yet.

Why is the VIX relevent for picking bottoms? The VIX represents movements in the premium paid by purchasing puts for protection in a downward market - bottoms tend to be put in when there is irrational fear and people/institutions want out at any price. Until we get that spike of fear, I don't think we've got a bottom.

Attachments

I'm sticking with previous forecasts of between 3400 - 3800.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,581

- Reactions

- 12,707

Personally, I reckon we're a fair way off the bottom in equity markets - the chart below represents the Dow Jones Index and the Volatility Index (VIX)... excuse the bad scaling, I had to use Yahoo Charts to get it.

What it does show is that significant bottoms tend to be put in place when the VIX is pushing 30. Right now it's just shy of 25, so I think there's a way to go yet.

Why is the VIX relevent for picking bottoms? The VIX represents movements in the premium paid by purchasing puts for protection in a downward market - bottoms tend to be put in when there is irrational fear and people/institutions want out at any price. Until we get that spike of fear, I don't think we've got a bottom.

Yup...

...and got up into the 40s in 01 and 02.

So plenty of panic is possible before a capitulation low.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,006

But,Yup...

...and got up into the 40s in 01 and 02.

So plenty of panic is possible before a capitulation low.

There doesn't have to be panic.

Does there?

Why not a controlled adjustment?

So far, the correction looks controlled and managed by the powers to be and us punters...

The irrational capitulation doesn't have to happen...

Or it does?

eeeeeek

doctorj

Hatchet Moderator

- Joined

- 3 January 2005

- Posts

- 3,271

- Reactions

- 8

Or dangling the carrot of hope to allow the big players an orderly exit before letting the great unwashed know that the game is up.So far, the correction looks controlled and managed by the powers to be and us punters...

Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

But,

There doesn't have to be panic.

Does there?

Why not a controlled adjustment?

So far, the correction looks controlled and managed by the powers to be and us punters...

The irrational capitulation doesn't have to happen...

Or it does?

eeeeeek

It's those oil speculators this time, I tell you... those mega funds manipulating the market.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

Or dangling the carrot of hope to allow the big players an orderly exit before letting the great unwashed know that the game is up.

Yeh, Michael Heffernan on 3AW this morning was very bullish on the market and also said interest rates should not have been put up and will probably return to 5 or 6%. So if you are a follower of Heffernan you know to look out below.

Like the old Telstra 2, it was all about helping the smart money out; and when you suffer a loss you learn the lessons well.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,018

- Reactions

- 11,006

Geeez,

Do the manipulators have the power to contol our market?

4800 has been my bottom for some time.

Don't know why.

Nice number.

I think I wore 48 once,,,

The **** looks to be 3500 though.

I have a few coins laying about for that possibility.

Do the manipulators have the power to contol our market?

4800 has been my bottom for some time.

Don't know why.

Nice number.

I think I wore 48 once,,,

The **** looks to be 3500 though.

I have a few coins laying about for that possibility.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,581

- Reactions

- 12,707

But,

There doesn't have to be panic.

Does there?

Why not a controlled adjustment?

That's always been what I think is most probable this time around..

... a re-run of the 70's.

Buuuuuuuut... the speed at which things have turned to sh!te over here has left even me aghast.

I'm not ruling anything in or out. And I have turned very timid about my short term downside exposure.

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

The 1929 crash was only part of it, the market continued to tank in steps for years from that point.

The real bottom line on higher food, oil and debt has not hit the government figures yet. Things will look very bad in the next year or two when they do. The jawboning cannot hide the truth indefinately.

The real bottom line on higher food, oil and debt has not hit the government figures yet. Things will look very bad in the next year or two when they do. The jawboning cannot hide the truth indefinately.

Similar threads

- Replies

- 8

- Views

- 449

- Replies

- 651

- Views

- 113K

- Replies

- 3

- Views

- 436

- Replies

- 4

- Views

- 1K