You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bitcoin price discussion and analysis

- Thread starter greggles

- Start date

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Bitcoin miner Core Scientific is filing for Chapter 11 bankruptcy — but plans to keep mining

Core Scientific, one of the largest publicly traded crypto mining companies in the U.S., is filing for bankruptcy protection.

Bitcoin miner Core Scientific is filing for Chapter 11 bankruptcy — but plans to keep mining

PUBLISHED TUE, DEC 20 2022 11:30 PM ESTUPDATED WED, DEC 21 2022 3:59 AM ESTJust highlights the folly and incredible waste of energy and special purpose compute hardware required to "mine" a dematerialized "asset".Bitcoin miner Core Scientific is filing for Chapter 11 bankruptcy — but plans to keep mining

"Core’s market capitalization had fallen to $78 million as of end of trading Tuesday, down from a $4.3 billion valuation in July 2021 when the company went public through a special purpose acquisition vehicle, or SPAC. The stock has fallen more than 98% in the last year."

Valuation once again confused with market capitalization based on price. Yet another SPAC gone bust. How many crypto mining rigs are just E-waste now?

"Core had previously said in a filing in October that holders of its common stock could suffer “a total loss of their investment,”

? That warning likely applies to every crypto project, exchange and venture.

The financial fallout from crypto mania continues apace.

- Joined

- 28 May 2020

- Posts

- 6,781

- Reactions

- 13,054

Russia is supposedly about to approve the use of Bitcoin as a payment mechanism for oil and a few other things.

From Bitcoin magazine

Mick

From Bitcoin magazine

Going to be hard for the US to sanction this one, its out side the BIS umbrella.Russia’s Congressional finance committee chairman, Anatoly Aksakov, said the country is moving to greenlight international trade in cryptocurrency within the next month, according to a report by national news agency TASS.

"In January, we want to legalize cryptocurrencies to ensure foreign trade activities," Aksakov said, per a translated version of the report.

The chairman highlighted that although Russia is taking steps to allow bitcoin and cryptocurrency payments for imports, there are no plans to encourage similar usage of the burgeoning assets within the boundaries of the nation’s territory.

"The circulation of cryptocurrencies as a means of payment on the territory of Russia will be prohibited, and liability will be prescribed in this regard," he reportedly stated. "But to pay for foreign trade transactions, we still assume the possibility of using cryptocurrencies, for example, for parallel imports."

Russian officials have teased at this possibility for almost a year, following an intense package of Western sanctions deployed in the wake of the nation’s invasion of Ukraine.

Mick

Not really what Bitcoin maximalists are hoping for, this puts only a small dent in the reserve currency status of the USD. No doubt counter parties would simply move in and out of Bitcoin solely for the purpose of competing a transaction to minimize the volatility risk of holding BTC. Forbidding "The circulation of cryptocurrencies as a means of payment on the territory of Russia..." must be considered a blow to maximalist ambitions for Bitcoin in Russia.Russia is supposedly about to approve the use of Bitcoin as a payment mechanism for oil and a few other things.

From Bitcoin magazine

Going to be hard for the US to sanction this one, its out side the BIS umbrella.

Mick

- Joined

- 28 May 2020

- Posts

- 6,781

- Reactions

- 13,054

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,849

- Reactions

- 10,701

I've been reading some of the Hedge Funds comments on BTC and Crypto in the WSJ and FT.

It would appear that with the FTX debacle their appetite for trading ( which has been overall profitable trading long and short ) is waning.

Their main worry is the safety of their "coin" on the blockchain particularly since the FTX debacle.

I can see either massive shorting or withdrawal of Funds' investment over the next few weeks.

Further I cannot see this consolidation around BTC= $16600 or thereabouts lasting on a TA basis.

gg

It would appear that with the FTX debacle their appetite for trading ( which has been overall profitable trading long and short ) is waning.

Their main worry is the safety of their "coin" on the blockchain particularly since the FTX debacle.

I can see either massive shorting or withdrawal of Funds' investment over the next few weeks.

Further I cannot see this consolidation around BTC= $16600 or thereabouts lasting on a TA basis.

gg

- Joined

- 3 July 2009

- Posts

- 27,866

- Reactions

- 24,922

Sounds like an international game of pass the parcel, I mean bitcoin, it will be interesting when the music stops to see who is carrying the oil and who is carrying the bitcoin.Russia is supposedly about to approve the use of Bitcoin as a payment mechanism for oil and a few other things.

From Bitcoin magazine

Going to be hard for the US to sanction this one, its out side the BIS umbrella.

Mick

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Bitcoin price nears 3-week high as trader says sub-7% CPI may see $19K

Bitcoin taps resistance at $17,000 amid a BTC price prediction of $19,000 thanks to CPI.

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,849

- Reactions

- 10,701

BTC is making a good attempt to crack $USD 1700 and break out of it's range over the last few months.Bets are increasing on a push higher for Bitcoin and on BTC price action defining the current range as its macro bottom.

Bitcoin price nears 3-week high as trader says sub-7% CPI may see $19K

Bitcoin taps resistance at $17,000 amid a BTC price prediction of $19,000 thanks to CPI.cointelegraph.com

Tonight when the US markets open will decide whether it will be successful or not.

My guess is it won't but it is a guess, and as good a one as anyone elses. Perhaps I'll be proven wrong.

gg

- Joined

- 3 May 2019

- Posts

- 6,353

- Reactions

- 10,051

Sometimes it's good to be wrong, for all the right reasons.My guess is it won't but it is a guess, and as good a one as anyone elses. Perhaps I'll be proven wrong.

Was watching a bit over the weekend and there were signs of life in the crypto world. Cracked through soon after you posted Mr Gumnut esquire.

I'm not interested really apart from the fact, if crypto is starting to run, it's relatively risk on time.

For how long? Dunno. How long does New Year hopium go for?

Edit. Had noticed some other cryptos had starting sneaking on the dailies last week.

You can see Spitcoin here did too....

PS, at time of posting, BTC seems to be about the worst performing on the rise. Others like Solana and Cardano are currently up 20 & 15% respectively in the last 24 hours

- Joined

- 24 May 2013

- Posts

- 582

- Reactions

- 773

Was watching a bit over the weekend and there were signs of life in the crypto world.

possibly people in jurisdictions operating on a jan-dec financial year (like the US) were selling in dec to book losses for tax purposes. those who did so in early-mid dec might be starting to buy back in now, as sufficient time should've passed for them to avoid breaching the wash sale rule.

- Joined

- 3 May 2019

- Posts

- 6,353

- Reactions

- 10,051

Well, to be fair, it's probably more fun that he doesn't disappear, and, he didn't say when he would delete his twatterI wonder if carl is going to regret this tweet from early 2022'

There are a few days to go, but I suspect he will be out of the money.

Mick

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Bitcoin flies high thanks in part to BlackRock's moveHow will the price of BTC be affected in the long run?

|

- Joined

- 3 May 2019

- Posts

- 6,353

- Reactions

- 10,051

Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 13,849

- Reactions

- 10,701

A 16% gain recently in BTC is not to be mocked.I've been calling it spitcoin lately.

I think it's back to a mining cost break even, from I understand?

I'm wondering where the money is coming from...

Up over 20% in 3 days ...

Interesting days with a broader indication now of reckless abandon risk on.

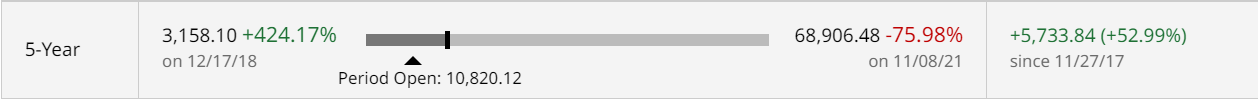

View attachment 151708

I still reckon that US Funds with large losses are buying and selling to get out at a reasonable loss with the beginning of the end for BTC.

No sour grapes though, but it may hold Gold back.

A profit is a profit.

gg

- Joined

- 28 May 2020

- Posts

- 6,781

- Reactions

- 13,054

Never a truer word spoken.A profit is a profit.

gg

Mick

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Top Crypto Trader Predicts Parabolic Bitcoin Surge to New All-Time High This Year – Here's His Target - The Daily Hodl

A popular crypto strategist is predicting a parabolic rally for Bitcoin this year now that BTC has broken a key psychological resistance at $20,000.

dailyhodl.com

dailyhodl.com

- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

Whales Move Over $363,000,000 in Bitcoin (BTC) and XRP in Several Transactions – Here’s Where the Crypto’s Going - The Daily Hodl

Deep-pocketed whales are suddenly moving more than $363 million in Bitcoin (BTC) and XRP after Bitcoin reclaims the $21,000 mark.

dailyhodl.com

dailyhodl.com

- Joined

- 28 August 2022

- Posts

- 7,232

- Reactions

- 11,804

Monopoly being played by the looks of it.In the largest of the three notable king crypto asset transactions on Thursday, January 19th, a whale moved 6,314 BTC worth $130,868,521 from one unknown wallet to crypto exchange Binance, according to Whale Alert.

Whales Move Over $363,000,000 in Bitcoin (BTC) and XRP in Several Transactions – Here’s Where the Crypto’s Going - The Daily Hodl

Deep-pocketed whales are suddenly moving more than $363 million in Bitcoin (BTC) and XRP after Bitcoin reclaims the $21,000 mark.dailyhodl.com

Similar threads

- Article

- Replies

- 2

- Views

- 1K

- Replies

- 10

- Views

- 4K