- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

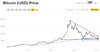

Quite a lot of thought going on in this market. Over 1,500 different coins and Bitcoin is adjusting to all the many events as well as the new lines of asset backed coins and gold backed cards. Always a guess but maybe leave it to late in 2018 as Bitcoin simply got well ahead of itself.