Lucky_Country

Formerly known as ijh

- Joined

- 30 June 2006

- Posts

- 738

- Reactions

- 0

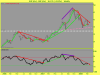

$40 was a resistance point for BHP too brake on its way down also seems too be on its way up.Like it downward path once it breaks could be in for a good run.

When well who knows but Iron Ore Coal and Oil at record levels may not be too long.

When well who knows but Iron Ore Coal and Oil at record levels may not be too long.