chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

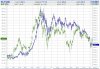

It would be an exponential trend, not a steady trend, and the rise in commodity prices I would argue have gone along that line.ducati916 said:China, has been on a growth explosion for 30yrs+

The 30yr average = 7.8%

That is huge.

Therefore, you would expect to see a steady state, or even a trend reflected within commodity prices, to reflect this steady, sustained, growth explosion in China........not even close.