You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BHP - BHP Group

- Thread starter still_in_school

- Start date

-

- Tags

- bhp bhp billiton bhp group

michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

nizar said:I agree.

The Yanks in particular view BHP as almost solely an oil business, and thus it trades there accordingly.

Another big earner for BHP is copper. Their sensitivity to the copper price is $20million in NPAT bottom line for every 1cent movement in price. Dont get me wrong - olympic dam was profitable at 70c/lb - but the fact that spot copper is taking a beating means BHP will suffer.

But as a long term hold, i can think of very few better stocks.

Nizar long term doesn copper price go down more? So why long term?

thx

MS

michael_selway said:Nizar long term doesn copper price go down more? So why long term?

thx

MS

Long term i think copper will be average around us$2.50/lb (2008 and beyond). It wont get to as low as us$1.80/lb (as most analysts use) because IMO the demand side of the equation has been altered permanently. After China you have India. India is at least 10 years behind China and even China has been growing for 27 years and its not slowing down. And then Brazil, Russia. People dont refer to the growth economies of the world as Chindia anymore. Its now called BRIC.

Dont forget that the copper stocks, though up 44% this year, are still very low by historical standards and accounts for only 3.1 days of global consumption. Any supply shocks and its welcome back for the bulls.

BHP is still VERY profitable at us$2.50/lb copper.

Also, Longer term oil will become more expensive (Ghawar will be no more in about 10 years), and uranium from Olympic Dam will make up a much larger part of BHPs earnings. A MUCH larger part.

Rederob and others, any ideas why BHP didnt hedge copper when it was ~us$3.70 knowing that at least in part, it will be THEIR OWN production increases that will bring down the spot price?

Obviously if this was to happen ie. hedging, analysts would all upgrade their long term earnings and the sp would also benefit. Surely Chip didnt think copper would stay in the high 3s forever?

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

Thanks for all the information guys, it's appreciated. I trade purely by chart, and have enough trouble doing that, I get a headache rivalling that given by a bad red when I attempt to fathom the micro/macro earnings/outlook side of things, so I pretty much leave the fundaments to the fundamentalists. The way I see it is if copper remains tarnished overnight and oil doesn't fire up then BHP's price on Moonday will reflect this and my entry invitation will not appear.

Famous last words...

Famous last words...

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,440

- Reactions

- 11,854

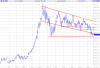

BHP entering top up territory for me. I think in the $24.00 - $26.00 zone it looks pretty good IMO. I am a believer in the stronger for longer thingy though, so if that doesn't happen, perhaps $10.00 will be a better price.

Should at least see a technical bounce from $26, $25 and $24, on the way down. If it keeps going down...I suppose it will if POC and POI keep sliding.....

Should at least see a technical bounce from $26, $25 and $24, on the way down. If it keeps going down...I suppose it will if POC and POI keep sliding.....

Attachments

kennas said:BHP entering top up territory for me. I think in the $24.00 - $26.00 zone it looks pretty good IMO. I am a believer in the stronger for longer thingy though, so if that doesn't happen, perhaps $10.00 will be a better price.

Should at least see a technical bounce from $26, $25 and $24, on the way down. If it keeps going down...I suppose it will if POC and POI keep sliding.....

POI?

Do you mean POO as in price of Oil ?

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,440

- Reactions

- 11,854

nizar said:POI?

Do you mean POO as in price of Oil ?

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,016

- Reactions

- 13,351

rosie said:Be careful punters...tried to warn you what the chart god's were saying

Eyes on copper too.

Overseas particularly, BHP is seen as a copper play... and copper needs to supported right here if the bulls are to have any chance.

michael_selway

Coal & Phosphate, thats it!

- Joined

- 20 October 2005

- Posts

- 2,397

- Reactions

- 2

wayneL said:Eyes on copper too.

Overseas particularly, BHP is seen as a copper play... and copper needs to supported right here if the bulls are to have any chance.

Yeah theres no more upside to Copper price imo

thx

MS

michael_selway said:Yeah theres no more upside to Copper price imo

thx

MS

Copper chart not happy.

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 26,016

- Reactions

- 13,351

rosie said:Be careful punters...tried to warn you what the chart god's were saying

Chart fwiw.

Attachments

wayneL said:Eyes on copper too.

Overseas particularly, BHP is seen as a copper play... and copper needs to supported right here if the bulls are to have any chance.

Maybe in London.

Yanks see it almost as a pure oiler.

Doesnt help much when oil and copper both tanking.

rosie said:Chart fwiw.

I think it is pointless showing the BHP price chart when you consider that Bluescope demerged from BHP along this timeline. Some of the rapid growth in the share price experienced by BHP over the last few years has been due to the economic environment, I am not questioning that. However getting rid of bluescope seem to improve earnings in a positive manner also. Business consolidation can sometimes improve cost efficiencies and refocuss the business. I think it is a little bit like comparing apples with oranges when you include a share price chart that includes a major restructuring within a business. In 03 BHP drops bluescope as evidenced by the reduction in shares outstanding below. Earnings per share improved dramatically by dropping this poor manufacturing component of the business. Not to mention BHP continues to buy back it's own shares with surplus cash. Therefore while the chart shows rapid growth and possible contraction I think I would prefer to use earnings data as a guide to forecasting the future over indicators. I don't disagree that the price of oil and copper will definately impact on earnings but the quantification of this impact can be calculated merely by multipling the segment of BHP business contributed by these areas then discounting back to an approximate price copper and oil maybe in two years, picking the worst case scenario, and presto an idea of where the earnings from these components of the business will be. Remember BHP is made up of 6 segments. By the way I don't own BHP, but if they creep a little lower I may be tempted.

May-97 May-98 May-99 Jun-00 Jun-01 Jun-02 Jun-03 Jun-04 Jun-05 Jun-05

Sales ($) 2.16 2.12 1.88 1.88 2.05 1.63 3.76

5.32 6.77 7.27

Cash flow (cents) 41.2 35.6 35 34.4 43.9 38.2 87.4 118.7 189.8 232.5

Earnings (cents) 14.3 13 3.6 17.8 28.7 19.4 45.3 78.2 128.4 225.4

Dividends (cents) 8.6 8.6 8.6 5.7 17.8 8 21.7 37.7 36.7 48.4

Franking (%) 51 100 100 -- 51 100 100 100 100 100

Capital Spending (cents) -49 -45 -31.8 -12.9 -39 -28.2 -70.3 -70.7 -92.8 -133.3

Book Value ($) 1.07 0.96 0.84 0.98 1.41 1.32 3 3.51 3.9 5.43

Shares outstand (m) 11,741.80 12,069.10 10,294.80 10,522.70 17,224.50 17,224.50 6,215.80 6,227.60 6,056.10 6,000.00

TheRage said:I think it is pointless showing the BHP price chart when you consider that Bluescope demerged from BHP along this timeline. Some of the rapid growth in the share price experienced by BHP over the last few years has been due to the economic environment, I am not questioning that. However getting rid of bluescope seem to improve earnings in a positive manner also. Business consolidation can sometimes improve cost efficiencies and refocuss the business. I think it is a little bit like comparing apples with oranges when you include a share price chart that includes a major restructuring within a business. In 03 BHP drops bluescope as evidenced by the reduction in shares outstanding below. Earnings per share improved dramatically by dropping this poor manufacturing component of the business. Not to mention BHP continues to buy back it's own shares with surplus cash. Therefore while the chart shows rapid growth and possible contraction I think I would prefer to use earnings data as a guide to forecasting the future over indicators. I don't disagree that the price of oil and copper will definately impact on earnings but the quantification of this impact can be calculated merely by multipling the segment of BHP business contributed by these areas then discounting back to an approximate price copper and oil maybe in two years, picking the worst case scenario, and presto an idea of where the earnings from these components of the business will be. Remember BHP is made up of 6 segments. By the way I don't own BHP, but if they creep a little lower I may be tempted.

That's your opininion which is fine, l trade what is on the chart, not fundamentals... as for being pointless l disagree, but willl keep in mind next time l have the urge to post a chart.

Cheers.

Kauri

E/W Learner

- Joined

- 3 September 2005

- Posts

- 3,428

- Reactions

- 11

You've gotta love these rumours.. from Metalsplace....

Predator Freeport-McMoRan Copper & Gold Inc. (FCX) may itself become a takeover target with Credit Suisse tipping a bid from mining giant BHP Ltd. (BHP) as a possibility.

Freeport is carrying out a US$25.9 billion friendly takeover of rival US miner Phelps Dodge Corp. (PD) that will create the world's biggest copper producer.

But the deal may never get done if Freeport itself becomes a target of the consolidation taking place in the global mining industry.

Credit Suisse said BHP Billiton and other global miners will be looking at Freeport "now that the Freeport/Phelps Dodge space is in play".

"The probability of BHP going beyond a cursory look would likely be around 50:50," Credit Suisse analysts said in a client note Wednesday.

Credit Suisse said funding the purchase would not stretch BHP and winning control of Freeport's Grasberg mine in West Papua would strengthen its copper position, lifting its reserves by about 30%.

The acquisition would also bring down average costs and make BHP the fourth lowest cost copper producer from its current position as sixth.

Freeport's free cash flow suggests a payback period of about seven years, which Credit Suisse said is "OK, but not a 'no brainer'".

But the purchase could also increase risk, Credit Suisse said, and BHP may have trouble convincing investors the deal makes more sense than an extension of its share buyback program.

Predator Freeport-McMoRan Copper & Gold Inc. (FCX) may itself become a takeover target with Credit Suisse tipping a bid from mining giant BHP Ltd. (BHP) as a possibility.

Freeport is carrying out a US$25.9 billion friendly takeover of rival US miner Phelps Dodge Corp. (PD) that will create the world's biggest copper producer.

But the deal may never get done if Freeport itself becomes a target of the consolidation taking place in the global mining industry.

Credit Suisse said BHP Billiton and other global miners will be looking at Freeport "now that the Freeport/Phelps Dodge space is in play".

"The probability of BHP going beyond a cursory look would likely be around 50:50," Credit Suisse analysts said in a client note Wednesday.

Credit Suisse said funding the purchase would not stretch BHP and winning control of Freeport's Grasberg mine in West Papua would strengthen its copper position, lifting its reserves by about 30%.

The acquisition would also bring down average costs and make BHP the fourth lowest cost copper producer from its current position as sixth.

Freeport's free cash flow suggests a payback period of about seven years, which Credit Suisse said is "OK, but not a 'no brainer'".

But the purchase could also increase risk, Credit Suisse said, and BHP may have trouble convincing investors the deal makes more sense than an extension of its share buyback program.

rosie said:TheRage said:I think it is pointless showing the BHP price chart when you consider that Bluescope demerged from BHP along this timeline. Some of the rapid growth in the share price experienced by BHP over the last few years has been due to the economic environment, I am not questioning that. However getting rid of bluescope seem to improve earnings in a positive manner also. Business consolidation can sometimes improve cost efficiencies and refocuss the business. I think it is a little bit like comparing apples with oranges when you include a share price chart that includes a major restructuring within a business. In 03 BHP drops bluescope as evidenced by the reduction in shares outstanding below. Earnings per share improved dramatically by dropping this poor manufacturing component of the business. Not to mention BHP continues to buy back it's own shares with surplus cash. Therefore while the chart shows rapid growth and possible contraction I think I would prefer to use earnings data as a guide to forecasting the future over indicators. I don't disagree that the price of oil and copper will definately impact on earnings but the quantification of this impact can be calculated merely by multipling the segment of BHP business contributed by these areas then discounting back to an approximate price copper and oil maybe in two years, picking the worst case scenario, and presto an idea of where the earnings from these components of the business will be. Remember BHP is made up of 6 segments. By the way I don't own BHP, but if they creep a little lower I may be tempted.

That's your opininion which is fine, l trade what is on the chart, not fundamentals... as for being pointless l disagree, but willl keep in mind next time l have the urge to post a chart.

Cheers.

I realise after reading my post again I came off being a little harsh. I am not anti chart. I use charts to help with my entry and exit but rely on the fundamentals for it to make sense.

- Joined

- 15 March 2006

- Posts

- 469

- Reactions

- 0

Kauri said:You've gotta love these rumours..

I will see your rumour and raise with this!

(EDITED BY ME)

=DJ Qantas May Be Precursor To Global Mega-Merger

By Rebecca Thurlow and Alex Wilson

Of DOW JONES NEWSWIRES

SYDNEY (Dow Jones)--With Qantas Airways Ltd. (QAN.AU) in the takeover spotlight,

analysts are now asking how long investors will have to wait before there is a truly

global mega-merger in Australia, perhaps with miner BHP Billiton (BHP) as a US$115

billion-plus target. "The broader implications are that no company really seems out of reach,

particularly those once thought perhaps too cyclical for private equity interest,"

said Matt Williams, a senior portfolio manager at Perpetual Investments.

"So really it confirms that no one is particularly safe in the market," said

Williams.

For fund managers, it is the latest example of the M&A frenzy in the local market

that Rob Patterson from funds manager Argo Investments complains could lead to his group

ending up as a "cashbox".

Charlie Aitken, head trader at institutional brokerage firm Southern Cross Equities,

said the offer put to Qantas has enormous ramifications for other bluechip stocks.

"If Qantas can attract private equity interest then just about the entire

Australian market is in play," Aitken said.

"People need to strongly consider the ramifications of this move; this is massive

news."

Visiting Australia last month from his New York base, Carlyle Group founder David

Rubenstein told the Australian Financial Review newspaper that the traditional reluctance

of private equity to buy natural resources companies because of their unpredictable

cashflow has changed.

"Previous to that, the resources sector was definitely thought of as being too

cyclical for private equity," said Greg Goodsell, equity strategist at ABN AMRO.

"Rubenstein's argument was that commodity prices will stay up and become less

cyclical, which makes those sorts of businesses potentially of interest."

JP Morgan analyst David George said global miners Rio Tinto (RTP) and BHP Billiton -

usually thought of as predators - could become targets.

"There is a lot of trapped value in those two companies," he said.

"They are big but there are some big transactions going on so we have got to start

thinking about who potentially might cop it."

Tim Sims, managing director of Australian-based Pacific Equity Partners, said the local

M&A pace will intensify.

"There's no structural reason why we shouldn't be seeing similar levels

of private equity involvement in deals as the U.K., Europe and the U.S.," Sims told

Dow Jones Newswires.

The mining and energy giant is based in Melbourne, with a global workforce of 38,000 in

25 countries. Its operations stretch across base metals and uranium mining, iron ore and

coal mining, and petroleum production.

"But what (private equity players) have found when they come here is there are

some great businesses with great management teams and a very stable economic environment,

which has resulted in great opportunities to make money," Knox said.

-By Rebecca Thurlow, Dow Jones Newswires; 61-2-8235-2959; rebecca.thurlow@dowjones.com

(Alex Wilson and Susan Murdoch in Melbourne, and Lyndal McFarland in Sydney

contributed to this article.)

-Edited by Ian Pemberton

(END) Dow Jones Newswires

November 22, 2006 02:06 ET (07:06 GMT)

Copyright (c) 2006 Dow Jones & Company, Inc.

_____________________________________________________