- Joined

- 19 January 2010

- Posts

- 428

- Reactions

- 0

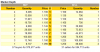

I see it breifly hit $1.18 and $1.17 for a bit. Now currently around the $1.155. On good volume too.

Here is the current buy/sell depth totals.:

52 buyers for 1,063,504 units

26 sellers for 462,250 units

Nice 2:1 ratio there. Now I wish I topped up when they were $0.97 a week ago

Now I wish I topped up when they were $0.97 a week ago

Here is the current buy/sell depth totals.:

52 buyers for 1,063,504 units

26 sellers for 462,250 units

Nice 2:1 ratio there.