- Joined

- 24 December 2005

- Posts

- 2,601

- Reactions

- 2,065

economics

Aussie's Crazy Day Shows Why It's Most Volatile Major Currency

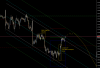

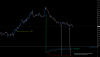

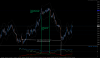

The Australian dollar is showing why it has been the most volatile Group-of-10 currency in the past month, swinging about 1.7 percent just in one day.

jobs data, forcing traders to close short positions. Less than an hour later, it sank when an influential economist at Westpac Banking Corp. said the central bank may cut rates twice. The Aussie got a reprieve on reports that the U.S. and China are nearing a trade deal, only to plunge more than 1 percent when Reuters reported that a Chinese port customs has banned its coal shipments indefinitely.

More....

Aussie's Crazy Day Shows Why It's Most Volatile Major Currency

The Australian dollar is showing why it has been the most volatile Group-of-10 currency in the past month, swinging about 1.7 percent just in one day.

jobs data, forcing traders to close short positions. Less than an hour later, it sank when an influential economist at Westpac Banking Corp. said the central bank may cut rates twice. The Aussie got a reprieve on reports that the U.S. and China are nearing a trade deal, only to plunge more than 1 percent when Reuters reported that a Chinese port customs has banned its coal shipments indefinitely.

More....