Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 1

Sorry Norman... I should have explained.

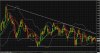

It's all about the big EW debate, which wave count.

It took out yesterdays high but not quite the 19th Jan high... so have to have a bit of a think about the EW implications of that.