Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

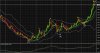

Couldn't help but have a quick look tonight first... but I think I'll stay on the sidelines until I'm able to spend some time on it.

Best guess at a quick glance, I think it may go something like this on the hourly.

In the wars matey!Wishing Whiskers a brisk recovery.Thanks for your point of view.