skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

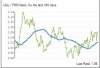

Trade #29. Long FWD @ $11.93. Short UGL @ $12.71. Size 8%.

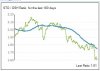

Added another 5%. Long CQR @ $3.28. Short CFX @ $1.955.

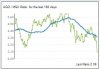

Trade #19. Long GPT / Short WRT. Two REITs that didn't go ex-div on Monday. Took me a while to work the entries and got $3.225 / $2.84. This is the 3rd time I've shorted WRT and usually this means I should stop doing it soon (i.e. it's going up for a reason unknown to me). Profit target is ~3.5%.

I like the sgp long trade at $3.12. I exited at $3.17 and re-entered at $3.12 in the smf a/c. Dont know enough about cqr (the other half of your pair) to comment on that one. But patience in sgp should see a return to $3.17+ imo. Good luck.

In queue for long DXS, short GPT, long MRM and NWH atm

Wish I have more capital to open more trades!

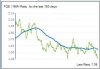

Charts...

Interested in how/whether you size depending on the slope of the ratio average you've got there.

e.g. full size when slope is 0/flat, reduced size inversely proportional to slope type of thing.

I size based on dispersion, but my spreads are sloped a lot flatter generally. The ones you posted look not much less trendy than an underlying security itself.

Trade #18 opened. Long BLY @ $2.835. Short ASL @ $3.275. Size 10%.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.