skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

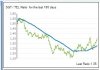

Long SUN/Short IAG - IAG put on 8% in 3 days with SUN moving ~2.5%. Profit target ~4%.

Trade closed. Sold SUN @ $7.95. Covered IAG @ $3.42. Profit = 2.8%. Over half of the work done in a day is usually my take profit. Depending on the market IAG probably has more to fall FWIW.