- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

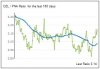

I am still trading divergence between like shares. The program signal alerts me to a statistical divergence, but these days I tend not to take the signal straight away. I wait for prices to enter zones of support / resistance / congestion and lean against those. And this usually offers me better entry prices - actually, I pretty much only enter if the entry prices are better. "Hedged trading" however is not a bad description and you can probably do that even if you don't run your pairs through any statistical analysis. But I do think the combination of sensible pairs, statistical divergence and basic chart reading improves performance.

Very good advice.

One thing you need to be careful of if your not doing the above is to remember that pairs trading tends to be counter trend so stocks may be showing relative strength or weakness for a good reason that is not yet taken on by the full market particapation!

L AMP S SUN just paid!