- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,523

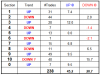

EOW 139 update: ASX Momentum Portfolio +90.7% (100% invested in 6 trades)

Benchmark index: SPAX2F15 (Incl. divs and f credits) +14.1% (past 139 wks)

This weeks sells: EHL (+1.3R), BUB (+1.4R), MND (+1.3R), PGH (+1.1R)

This weeks buys: BPT, TPM, ASL

The market paused this week as we thought it might after such a strong rally. Our portfolio continued to increase in value as we grabbed profits along the way. Another equity high due to the bullish market conditions.

Our desire to grab profits quickly sometimes seems a waste of effort as a few prices gallop ahead after we sell. We've implemented a re-entry tactic to try to minimise this wastage. Sometimes we get lucky and jump into another winning trade immediately. This is more likely to happen in a bullish market rally like we've just experienced. It's the main reason for our current profitable batch of trades.

We've cashed nine consecutive winning trades. A new thread record and this has propelled our equity curve into space (parabolic trajectory).

Outlook: WU DU. This market pause will create great trend continuation patterns for us to use. We've temporarily run out of cash. We'll close a trade next week so that we can buy another break-out.

Benchmark index: SPAX2F15 (Incl. divs and f credits) +14.1% (past 139 wks)

This weeks sells: EHL (+1.3R), BUB (+1.4R), MND (+1.3R), PGH (+1.1R)

This weeks buys: BPT, TPM, ASL

The market paused this week as we thought it might after such a strong rally. Our portfolio continued to increase in value as we grabbed profits along the way. Another equity high due to the bullish market conditions.

Our desire to grab profits quickly sometimes seems a waste of effort as a few prices gallop ahead after we sell. We've implemented a re-entry tactic to try to minimise this wastage. Sometimes we get lucky and jump into another winning trade immediately. This is more likely to happen in a bullish market rally like we've just experienced. It's the main reason for our current profitable batch of trades.

We've cashed nine consecutive winning trades. A new thread record and this has propelled our equity curve into space (parabolic trajectory).

Outlook: WU DU. This market pause will create great trend continuation patterns for us to use. We've temporarily run out of cash. We'll close a trade next week so that we can buy another break-out.