- Joined

- 12 January 2008

- Posts

- 7,407

- Reactions

- 18,523

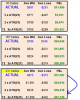

There's also been significant development between the active daily trader and the weekly warrior. The YTD performance of the active trading style has finally passed the relaxed weekly performance. The active style got into the rally as it happened while the weekly manager added to the portfolio near the EOW. The Jan17 weekly portfolio is now 84% invested (9 positions).

Hopefully we'll hold on to this lead all the way to the EOY finish line as we attack our own end goal.

Hopefully we'll hold on to this lead all the way to the EOY finish line as we attack our own end goal.