- Joined

- 12 January 2008

- Posts

- 7,409

- Reactions

- 18,525

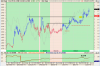

Trading update: My daily market risk indicator has turned down indicating that there is a higher probability of lower prices in the short term. This change means that its time to reduce our portfolio heat slightly and be a bit more defensive. However our recent cautious approach has kept the portfolio heat at comfortable levels and we've been able to raise our exit stops on many of the trades. Raising them higher would only strangle the trades and force their closure. The market risk indicator is there as an objective warning signal and if we hadn't already raised the exit stops, now is the time to do it. Let's review our open trades. We're going to close a few to refresh the portfolio but there is no hurry to do it.

NVT: We've been in this trade for quite a while (78d). This is unusual for a short term momentum trading style, but as the trend was reasonably strong we stuck with it. The price swing up is not impulsive which means it's corrective in nature and we can anticipate that the next impulsive move may be down. For this reason we're closing this trade with a sell limit of 5.32 to reduce our heat.

Note: My personal exit stop for this stock is at 4.80 and from a medium term perspective (weekly chart) there is no reason to sell.

EGH: Continues to move slowly higher and is now at our T2 target price (and yearly high). I've been concerned by the thin market depth for some time and the price can fall 0.03 - 0.04 easily on any day. We are going to sell this one at 0.74.

Note: My personal exit stop is at 0.60 (BE) and there is no reason to sell looking at the weekly chart.

EPD, GXL: Price remains near the BO levels and I'm inclined to leave them. There is no point (room) raising our exit stops without strangling the trade.

IMF: Nice bullish day yesterday (1/6/16), with some selling today. Price is near the 1.50 level and we can anticipate some resistance at this level. Our exit stop is at 1.30 which leaves enough room for us to wait and see where price goes next.

LPE: The opportunity to sell at 0.049 is passed. Now, do we allow price to fall further or take the +1R profit. As this is a short term trading thread lets take the profit.

These exits will allow us to refresh the portfolio with newer opportunities and we'll be on the lookout immediately. The market pause will create the setups that we want to trade and if the market dips then we will wait for our setups without concern for our portfolio value.

NVT: We've been in this trade for quite a while (78d). This is unusual for a short term momentum trading style, but as the trend was reasonably strong we stuck with it. The price swing up is not impulsive which means it's corrective in nature and we can anticipate that the next impulsive move may be down. For this reason we're closing this trade with a sell limit of 5.32 to reduce our heat.

Note: My personal exit stop for this stock is at 4.80 and from a medium term perspective (weekly chart) there is no reason to sell.

EGH: Continues to move slowly higher and is now at our T2 target price (and yearly high). I've been concerned by the thin market depth for some time and the price can fall 0.03 - 0.04 easily on any day. We are going to sell this one at 0.74.

Note: My personal exit stop is at 0.60 (BE) and there is no reason to sell looking at the weekly chart.

EPD, GXL: Price remains near the BO levels and I'm inclined to leave them. There is no point (room) raising our exit stops without strangling the trade.

IMF: Nice bullish day yesterday (1/6/16), with some selling today. Price is near the 1.50 level and we can anticipate some resistance at this level. Our exit stop is at 1.30 which leaves enough room for us to wait and see where price goes next.

LPE: The opportunity to sell at 0.049 is passed. Now, do we allow price to fall further or take the +1R profit. As this is a short term trading thread lets take the profit.

These exits will allow us to refresh the portfolio with newer opportunities and we'll be on the lookout immediately. The market pause will create the setups that we want to trade and if the market dips then we will wait for our setups without concern for our portfolio value.