Value Collector

Have courage, and be kind.

- Joined

- 13 January 2014

- Posts

- 12,242

- Reactions

- 8,496

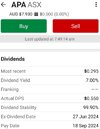

APA could actually quite easily pay off their debt if needed, they would just have to stop paying dividends for a while.OK but regulators and regulations change

now i can't imagine an Australia without gas .. but that is the agenda being pushed by some ( influential talking heads )

even our finance regulators got a big shake-up not so long back

At the moment Coal is Public enemy number one, and Australia plans to wean itself of coal over the next 25 years, but to do that will take a lot of renewables and gas.

In fact gas demand is projected to increase over the next 20 years as it is used to back up renewables as coal is phased out, also APA is a large investor is renewables and electricity transmission, so the climate change movement is kinda playing into APA’s hands.

(if you go back in this thread I have already explained how APA good clear their debt in a marathon discussion I had a few years ago with Luutz)