- Joined

- 20 July 2021

- Posts

- 11,582

- Reactions

- 16,107

in the current scenario , i see the rush to buy-backs as a desperate attempt to buy-out hostile share-holders

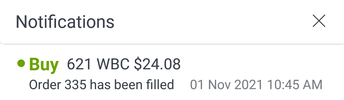

( i hold a small number of WBC because i dumped them ex. div )

i had previously exited ANZ completely

what i will enjoy watching is

the big institutional investors ( and fund managers ) happily lend out the share-holding to short-sellers ( and other 'activists )

if you think i am crazy watch for them to start issuing convertible debt/hybrids in the coming year ( guessing the easy credit to them will dry up )

cheers

( i hold a small number of WBC because i dumped them ex. div )

i had previously exited ANZ completely

what i will enjoy watching is

the big institutional investors ( and fund managers ) happily lend out the share-holding to short-sellers ( and other 'activists )

if you think i am crazy watch for them to start issuing convertible debt/hybrids in the coming year ( guessing the easy credit to them will dry up )

cheers