DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 893

- Reactions

- 2,123

23/4/24 9.40am.

Brokers are pushing their own agendas with this Too Expensive Crap...

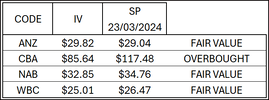

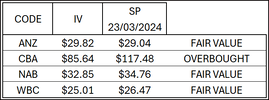

The Grid Below explains my view..... .

Yes, CBA is Overbought/Expensive, but the other 3 Mums & Dads Stocks, ANZ, NAB & WBC, are Fair Value ATM...

The only Q we need to ask is WHY are they publishing that Self Serving Rubbish....

"Too Expensive" is the correct wording for someone wanting to Buy Banks at Lower Prices.

so obviously, they are trying to push the SP Down.....

What we need to do now is use the info to our advantage....

Wake Up Aussies....

Brokers are pushing their own agendas with this Too Expensive Crap...

The Grid Below explains my view..... .

Yes, CBA is Overbought/Expensive, but the other 3 Mums & Dads Stocks, ANZ, NAB & WBC, are Fair Value ATM...

The only Q we need to ask is WHY are they publishing that Self Serving Rubbish....

"Too Expensive" is the correct wording for someone wanting to Buy Banks at Lower Prices.

so obviously, they are trying to push the SP Down.....

What we need to do now is use the info to our advantage....

Wake Up Aussies....