- Joined

- 22 July 2009

- Posts

- 602

- Reactions

- 0

Only trouble is I am not seeing any indication that gamma outweighs theta using this method. am i doing it wrong, or perhaps you are meaning spreads that start further out in time?

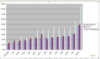

x-axis: spot price, y-axis: superimpose gamma and theta.

Here is the plot for a long call payoff: S=100, t=30, volty=15%, r=10%, you can play with the calendar equivalent.

Mathematically, approximation between the two partials:

Code:

-theta ~ 0.5 * gamma * S^2 * sigma^2By gamma risk I suppose we are really referring to a risk of 'movement away from current price'

Perhaps this difference would be a good topic to discuss? I am certainly interested to learn about it.

vi, I respectfully disagree with your interpretation of gamma, and sinner, that is a good topic to discuss but I must let Wayne have his fun!!!