- Joined

- 13 June 2007

- Posts

- 838

- Reactions

- 136

morning folks, wondering if anyone can help me!

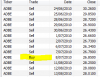

I'm wanting to look at the performance of the market for certain dates(I'm looking at past econ data release dates). I know how to code one particular date into AFL using the datenum() function and have it print an arrow on the chart for that particular day, but how would I go about that for multiple instances( well over 150 ).

Any help greatly appreciated

Hi Professor --

The date you want to flag needs to be coded in or read in -- I'll leave that for another posting if it is necessary. For now, assume that the date you want to use is: July 21, 2010

The AmiBroker equivalent is: 1100721

You can see the relationship: concatenate together: (Year-1900) in three digits, month in two digits, day in two digits.

One way is to assign the date to a variable

DateOfInterest = 1100721;

For ease of programming, store the date associated with each bar in a variable:

dn = datenum(); // do this once

The code to put a signal on that date is:

SignalDate = dn == DateOfInterest;

If you want to Buy on that date:

Buy = SignalDate;

If you want to plot showing that date:

shapes = ShapeUpArrow * SignalDate;

shapecolor = colorRed;

plotshapes(shapes,shapecolor);

Or have I misunderstood?

Thanks,

Howard