You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

123 Formation as Trend Continuation Setup

- Thread starter persama

- Start date

RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

persama said:Watchlist for Jul 01, 2005

Potential 123 trades:

LUFK - Broke Point #2 ( 36.20 ). Recommended Initial Stop at 33.90

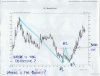

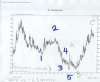

Just thought I'd post these charts as I was checking them as it is much easier to understand the trade graphically for me- LUFK also has one of those 'hindsight' trades in May for the 123 method (the long term chart confirms that it was still a trend continuation- as required by Persama's method (also note the blue EMA which confirms it)). Charts are 1 mth and 3mths.

Attachments

RichKid

PlanYourTrade > TradeYourPlan

- Joined

- 18 June 2004

- Posts

- 3,031

- Reactions

- 5

Persama,

Do you use the 50 & 200 ema in your trades? eg to find a 'continuation' ie when 50 is over 200. That way you could develop a mechanical system I guess so that it filters some candidates for you. Just wondering as those ma's were in one of your charts.

Also in terms of the timeframe tech refers to, do you look to trade on a weekly basis (ie most trades are closed within a few weeks) or do you just let the trade run as long as it's not hitting the trailing stop?

Do you use the 50 & 200 ema in your trades? eg to find a 'continuation' ie when 50 is over 200. That way you could develop a mechanical system I guess so that it filters some candidates for you. Just wondering as those ma's were in one of your charts.

Also in terms of the timeframe tech refers to, do you look to trade on a weekly basis (ie most trades are closed within a few weeks) or do you just let the trade run as long as it's not hitting the trailing stop?

Currently I am not using ma as my filter but am thinking of to 'borrow' Stan Weinstein's idea to refine the system....still backtesting the new idea.RichKid said:Persama,

Do you use the 50 & 200 ema in your trades? eg to find a 'continuation' ie when 50 is over 200. That way you could develop a mechanical system I guess so that it filters some candidates for you. Just wondering as those ma's were in one of your charts.

Also in terms of the timeframe tech refers to, do you look to trade on a weekly basis (ie most trades are closed within a few weeks) or do you just let the trade run as long as it's not hitting the trailing stop?

Watchlist for Jul 07, 2005

Potential 123 trades:

ASFI, CAND, CTHR, DCGN, ENTU, ITRI, PANL, PGIC

Updates:

KOPN - Broke Point #2 ( 5.72 ). Recommended Initial Stop at 5.01

SBAC - Broke Point #2 ( 14.32 ). Recommended Initial Stop at 13.20

THOR - Broke Point #2 ( 15.93 ). Recommended Initial Stop at 15.02

AMTD - Lower High is formed. Trade abandoned.

OTIV - Lower High is formed. Trade abandoned.

Potential 123 trades:

ASFI, CAND, CTHR, DCGN, ENTU, ITRI, PANL, PGIC

Updates:

KOPN - Broke Point #2 ( 5.72 ). Recommended Initial Stop at 5.01

SBAC - Broke Point #2 ( 14.32 ). Recommended Initial Stop at 13.20

THOR - Broke Point #2 ( 15.93 ). Recommended Initial Stop at 15.02

AMTD - Lower High is formed. Trade abandoned.

OTIV - Lower High is formed. Trade abandoned.

- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

ITRI - Lower High is formed. Trade abandoned.

I think ITRI's ready to go up now because it has been consolidating without moving down too much.

Watch it move.

- Joined

- 21 December 2004

- Posts

- 674

- Reactions

- 1

DTM said:I think ITRI's ready to go up now because it has been consolidating without moving down too much.

Watch it move.

There's your rocket. Up 78 cents within the first hour and half of trading. Just happened to be up making baby's bottle.

Hope you caught that one.....

- Joined

- 6 May 2005

- Posts

- 318

- Reactions

- 1

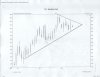

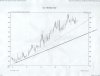

123...... FORMATIONS

HAS ITS ORIGINS TIED to ELLIOTT WAVES ....

The ABC SECTION OF an ELLIOTT WAVE formation is identical ....

The point labeled # 3 is a retracement level off of the distance between point number #1 and point # 2

IN WHICH THE RETRACEMT LEVEL IS A FIBONACCI NUMBER ......

EXAMPLE 50% , 618 % 786 % ,,,,,,

ALWAYS RETRACEMENTS ARE PRESENT .........

…………….Please, don't give me credit for pointing out these lines ... I have learned them form studying the work of Fibonacci Retracements and Elliott Waves ..... These lines work well only when they are tied to certain Elliott Wave structures and certain Fibonacci Retracement levels ..... outside of this they become less reliable...... a whole lot less reliable .

This is exactly the reason why you could never back test a particular stock or commodity for these lines without these 2

basic theories of understanding. NOT ALL CHART PATTERNS ARE TRADEABLE .

(This depends on your trading strategy or trading style )

ALWAYS REMEMBER ….

What makes a market place is all of our diffrences of opinions .

------- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

It is far more difficult to Exit a trade than to Enter a trade .... I am sure that you have heard that said before ,,,

THIS IS WHY ,

When making trade it just as important to have an idea where you want to exit as it is to place a stop to protect yourself from a move against you .

( THIS IS A PEARL OF WISDOM )

HAS ITS ORIGINS TIED to ELLIOTT WAVES ....

The ABC SECTION OF an ELLIOTT WAVE formation is identical ....

The point labeled # 3 is a retracement level off of the distance between point number #1 and point # 2

IN WHICH THE RETRACEMT LEVEL IS A FIBONACCI NUMBER ......

EXAMPLE 50% , 618 % 786 % ,,,,,,

ALWAYS RETRACEMENTS ARE PRESENT .........

…………….Please, don't give me credit for pointing out these lines ... I have learned them form studying the work of Fibonacci Retracements and Elliott Waves ..... These lines work well only when they are tied to certain Elliott Wave structures and certain Fibonacci Retracement levels ..... outside of this they become less reliable...... a whole lot less reliable .

This is exactly the reason why you could never back test a particular stock or commodity for these lines without these 2

basic theories of understanding. NOT ALL CHART PATTERNS ARE TRADEABLE .

(This depends on your trading strategy or trading style )

ALWAYS REMEMBER ….

What makes a market place is all of our diffrences of opinions .

------- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

It is far more difficult to Exit a trade than to Enter a trade .... I am sure that you have heard that said before ,,,

THIS IS WHY ,

When making trade it just as important to have an idea where you want to exit as it is to place a stop to protect yourself from a move against you .

( THIS IS A PEARL OF WISDOM )

Attachments

Similar threads

- Replies

- 12

- Views

- 2K

- Replies

- 10

- Views

- 4K

- Replies

- 141

- Views

- 33K