We do whatever works for us. If someone is making money from a method that’s very different to mine, then good luck to him.

Personally I’ve never seen any sense in holding on to dogs for prolonged periods of time, when you could instead have your capital better employed in a stock that’s heading solidly upward.

The market decides the value of a stock. You or I do not. Time and again I’ve known people to buy stocks because they considered them realistic value or undervalued. And time and again I’ve watched those same stocks go down down down.

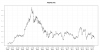

A mate used to pass on Renee Rivkin’s newsletter to me. Rivkin liked a stock called Pasminco so much that he recommended it in a number of his newsletters as ‘good value at these prices’. Pasminco continued heading south and the company eventually went broke.

A bloke I met at an options night told me he lost ‘well in excess of a six figure sum’ by buying more Pasminco shares every time they fell by another ten percent. He fell into the trap of thinking ‘it has to be good value at these prices, it has to be even better value now that it’s fallen even further. He could have avoided his big loss, and quite likely made substantial profits instead, simply by avoiding a dog like Pasminco and putting his money into some up trending stocks instead.

Personally I’ve never seen any sense in holding on to dogs for prolonged periods of time, when you could instead have your capital better employed in a stock that’s heading solidly upward.

The market decides the value of a stock. You or I do not. Time and again I’ve known people to buy stocks because they considered them realistic value or undervalued. And time and again I’ve watched those same stocks go down down down.

A mate used to pass on Renee Rivkin’s newsletter to me. Rivkin liked a stock called Pasminco so much that he recommended it in a number of his newsletters as ‘good value at these prices’. Pasminco continued heading south and the company eventually went broke.

A bloke I met at an options night told me he lost ‘well in excess of a six figure sum’ by buying more Pasminco shares every time they fell by another ten percent. He fell into the trap of thinking ‘it has to be good value at these prices, it has to be even better value now that it’s fallen even further. He could have avoided his big loss, and quite likely made substantial profits instead, simply by avoiding a dog like Pasminco and putting his money into some up trending stocks instead.