- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

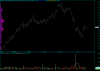

I've been trading the market long during the run up.

Now the market has topped and it looks like there may be some downside potential.

One way that I've been looking to profit from the global market conditions is to short the FTSE.

How about the Aussie market? The SPI Futures is a bit rich for me at $25 per 1 point movement.

What about shorting the banks?

Could it be worth shorting them on this current leg up? I'd be looking in conjunction with the broader market.

Having watched the XAO closely and seen a topping pattern in real time it was frustrating not being able to trade the SPI due to my risk profile. That got me thinking about maybe shorting the banks instead. It would have been an excellent move.

Just interested to see if others share similar sentiments...

Now the market has topped and it looks like there may be some downside potential.

One way that I've been looking to profit from the global market conditions is to short the FTSE.

How about the Aussie market? The SPI Futures is a bit rich for me at $25 per 1 point movement.

What about shorting the banks?

Could it be worth shorting them on this current leg up? I'd be looking in conjunction with the broader market.

Having watched the XAO closely and seen a topping pattern in real time it was frustrating not being able to trade the SPI due to my risk profile. That got me thinking about maybe shorting the banks instead. It would have been an excellent move.

Just interested to see if others share similar sentiments...