- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

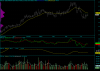

What is the rational behind this NAB trade?

Pushing up to the gap and previous resistance with volume decreasing.

XAO a little push up which could result in another down leg soon.

Probably a low risk entry