- Joined

- 28 August 2022

- Posts

- 7,021

- Reactions

- 11,355

As Nugget used to say Gold, Gold, Gold.I'd say the reinflation narrative is an absolute given.

look at gold ...winner

As Nugget used to say Gold, Gold, Gold.I'd say the reinflation narrative is an absolute given.

look at gold ...winner

I agree. Actually the following story from just last Wednesday confirms it for me.

"A particular product's price may go up," he conceded, while arguing that levies would not cause broad inflation. "It is just nonsense to say that tariffs cause inflation. It’s nonsense."

Howard Lutnick, Trump Commerce secretary pick, says it's 'nonsense' that tariffs cause inflation

President Donald Trump’s nominee to lead the Commerce Department, Howard Lutnick, told senators the argument that tariffs cause inflation is "nonsense" during a confirmation hearing.www.foxnews.com

I agree. Actually the following story from just last Wednesday confirms it for me.

"A particular product's price may go up," he conceded, while arguing that levies would not cause broad inflation. "It is just nonsense to say that tariffs cause inflation. It’s nonsense."

Howard Lutnick, Trump Commerce secretary pick, says it's 'nonsense' that tariffs cause inflation

President Donald Trump’s nominee to lead the Commerce Department, Howard Lutnick, told senators the argument that tariffs cause inflation is "nonsense" during a confirmation hearing.www.foxnews.com

well it MIGHT be different this time , but that has been the trend in the last 60 years ( i have been interested in prices )Well he would say that wouldn't he ? After all he is Totally Loyal to The Don and whatever Trfump says goes doesn't it ..

In terms of the effects of Tariffs on price rises across the economy. Suddenly a whole range of imported products increase prices by 10-30%.

In which universe does the the US alternative not drift it's prices higher if the competition is now either non existent or not competitive?

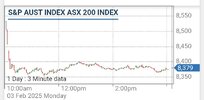

The colour Green is dominant so far today, Whoopie do dar.

Morning Wrap: ASX 200 to rise, S&P 500 bounces + Pinnacle, Amcor earnings

ASX 200 futures are up 53pts (+0.63%) as of 8:30 am AEDT.www.marketindex.com.au

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.