Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,261

- Reactions

- 11,660

Well it was never going to last forever. I have the co-ordinates of all my Gold Bar buried safely throughout the nation but am only able to access easily that which is in Queensland and the NT.

Thus it is time to dig up the bar, sell in to AUD and then ....

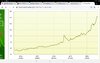

I'll have time to think about it while I dig. Between the virus, the Orange Clown in the White House and the number of specie gold stocks being given electric shock treatment, the price should meander between $2700 and $2900 AUD, before it crashes.

And if it keeps on going up then all the better.

gg

Thus it is time to dig up the bar, sell in to AUD and then ....

I'll have time to think about it while I dig. Between the virus, the Orange Clown in the White House and the number of specie gold stocks being given electric shock treatment, the price should meander between $2700 and $2900 AUD, before it crashes.

And if it keeps on going up then all the better.

gg